There was a time when access to a Bloomberg terminal separated serious finance teams from everyone else.

Not because it made decisions for you, but because it gave you clarity, context, and control at speed.

Accounts Payable never had its Bloomberg moment. Until now.

For years, Accounts Payable tools promised speed but delivered fragility. They handled the happy path well and collapsed the moment reality intruded. An invoice arrived in an unexpected format. A tax rule behaved differently in one geography. A vendor used language that did not match the master data. Human teams were left to patch the gaps, often under deadline pressure and audit scrutiny.

Neil was born out of that frustration.

And Neil 1.0.1 represents the clearest expression yet of what happens when automation is built not for demos, but for the way finance actually works.

Thousands of Hours Behind a Quiet Upgrade

The release of Neil Platform Version 1.0.1 did not begin with a roadmap slide or a marketing brief. It began years earlier, inside enterprise finance teams, shared services centers, and global operations where invoices do not arrive neatly, and exceptions are the norm, not the edge case.

The team behind Neil spent thousands of hours working alongside finance leaders, AP managers, tax specialists, and ERP teams. Not interviewing them once, but sitting with them through month-end closes, backlog spikes, vendor escalations, and audit cycles. That exposure shaped every architectural decision.

At the same time, the Neil website itself has been reimagined. The launch is not cosmetic. It reflects a platform that has grown up, matured, and learned from real production complexity. Today, users can directly engage with Neil through conversational interfaces, ask questions about workflows, exceptions, or system behavior, and get grounded answers rooted in live operational context.

The website is no longer just a place to read about Neil. It is an entry point into how Neil thinks.

From Automation Features to Agentic Architecture

Most Accounts payable platforms still think in terms of features. Ingestion. Extraction. Matching. Posting. Each function exists as a separate capability, often stitched together through brittle handoffs.

Neil 1.0.1 operates differently.

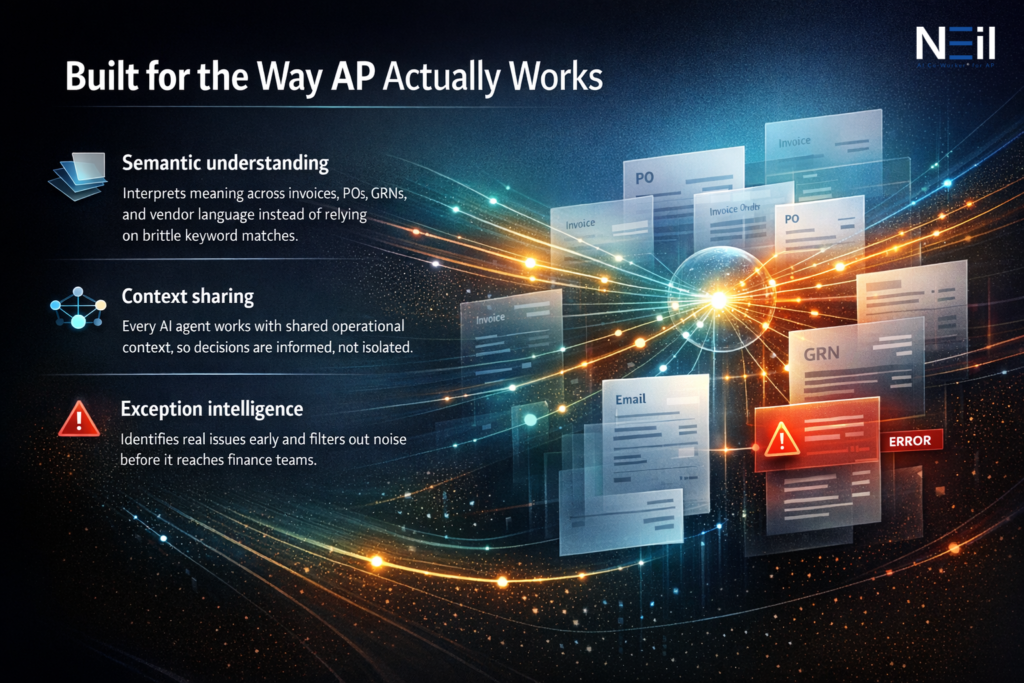

At its core is an agentic AI architecture where specialized AI agents handle distinct responsibilities but share context through a common orchestration layer. These agents do not act independently. They collaborate.

An ingestion agent understands where an invoice came from and why it arrived the way it did. A document intelligence agent interprets structure, language, and layout without relying on static templates. A tax agent applies jurisdiction-specific logic with awareness of statutory nuance. A matching agent reasons semantically across purchase orders, goods receipts, and invoice lines rather than relying on brittle keyword alignment. Validation and exception agents operate continuously, not as a final gate.

When one agent makes a decision, others understand the context in which that decision was made. This is how Neil avoids the fragmented behavior that plagues traditional AP systems.

Reliability as a Design Principle

One of the most meaningful outcomes of this architecture is consistency at scale.

Neil already operates at a sustained straight-through processing rate above ninety percent in enterprise environments. That number matters, but not because it sounds impressive. It matters because it is achieved without narrowing the scope of what the system is willing to process.

Neil, our accounts payable automation solution handles multi-geography operations, multi-language invoices, and multi-format documents across regions with complex tax regimes and regulatory requirements. It does this not by flattening differences, but by understanding them.

Localization is not treated as an afterthought. Country-specific date formats, decimal conventions, statutory identifiers, and tax behaviors are embedded directly into the system logic. This allows finance teams to operate with confidence across regions without maintaining parallel workflows or manual workarounds.

Reliability, in Neil’s world, is not about perfection. It is about predictability. Finance teams need systems that behave consistently under pressure, not tools that require constant supervision.

Tax and Compliance Without the Guesswork

Tax automation is where many AP platforms quietly fail.

Neil 1.0.1 introduces a deeply integrated tax computation engine that operates as part of the workflow, not as a bolt-on. VAT and withholding calculations are applied using country-specific rules. Tax codes are mapped automatically based on ERP master data. Multi-jurisdiction scenarios are handled explicitly rather than approximated.

Most importantly, every tax decision is traceable.

Finance teams can see not just what value was applied, but why. This level of transparency is critical in audit-heavy environments where explanations matter as much as outcomes.

Semantic Matching for the Real World

Traditional matching engines struggle when invoices and purchase orders do not align perfectly. Neil’s semantic N-way matching changes that dynamic.

Instead of treating documents as rigid strings of text, our AP automation solution interprets meaning. It understands that descriptions vary, that line items may not match verbatim, and that real-world procurement is rarely clean. This reduces false mismatches and exception volumes, especially in high-volume environments with complex purchase structures.

Approvals move faster because fewer invoices get stuck for the wrong reasons.

Exceptions as Signals, Not Failures

Neil 1.0.1 expands exception management into a first-class capability. Over thirty predefined exception categories cover extraction errors, validation issues, matching discrepancies, and posting failures. Each exception is tracked against service levels, escalated intelligently, and logged with context.

This gives finance leaders visibility into systemic issues rather than forcing them to fight fires blindly. Exceptions become signals that inform process improvement, not just interruptions to be cleared.

Built for Enterprise Reality

Under the hood, the platform has been strengthened for enterprise-grade reliability. API retries, auto-recovery mechanisms, faster document deskewing, improved currency and date recognition, and better handling of large invoice batches all contribute to stability that is felt quietly, day after day.

ERP integration has also been expanded. Neil connects deeply with systems like SAP Ariba and SAP ECC6, supports structured flat file posting with recovery mechanisms, and offers configurable adapters for other ERPs. The goal is not to force enterprises into a new operating model, but to fit into the one they already trust.

Analytics That Tell a Story

With thirteen new reports and a custom report builder, Neil provides visibility into invoice aging, exception patterns, lifecycle performance, backlog trends, productivity, service levels, and accruals.

These are not vanity dashboards. They are tools for decision-making.

Finance leaders can see where processes slow down, where risk accumulates, and where automation is delivering real value.

Looking Ahead

Neil 1.0.1 is not an endpoint. It is a milestone that reflects years of learning from real enterprise environments and a commitment to building systems that finance teams can rely on when it matters most.

For organizations rethinking how Accounts Payable should operate in a world of scale, regulation, and constant change, Neil today looks very different from what automation used to mean.

And that is exactly the point.