Accounts payable stands at a pivotal moment in its evolution. No longer viewed merely as a back-office cost center, AP is rapidly transforming into a strategic function that directly impacts organizational cash flow, vendor relationships, and financial intelligence. This transformation is powered by one critical catalyst: automated invoice processing.

The traditional invoice processing model is crumbling under its own weight. Finance teams processing invoices manually face error rates of approximately two percent annually, translating to 200 hours of additional labor for every 10,000 invoices. Traditional approaches reliant on manual data entry and paper-based workflows are inefficient and unsustainable, exposing organizations to costly errors, fraud, and strained vendor relationships.

Meanwhile, the rise of automated invoice processing in modern finance teams signals a fundamental shift. Over 60 percent of finance professionals expect full accounts payable invoice automation by 2025, with artificial intelligence reducing human errors by up to 40 percent. The accounts payable automation market is projected to reach $8.3 billion by 2031, underscoring that invoice process automation has evolved from a competitive advantage to a baseline requirement for survival in today’s digital-first economy.

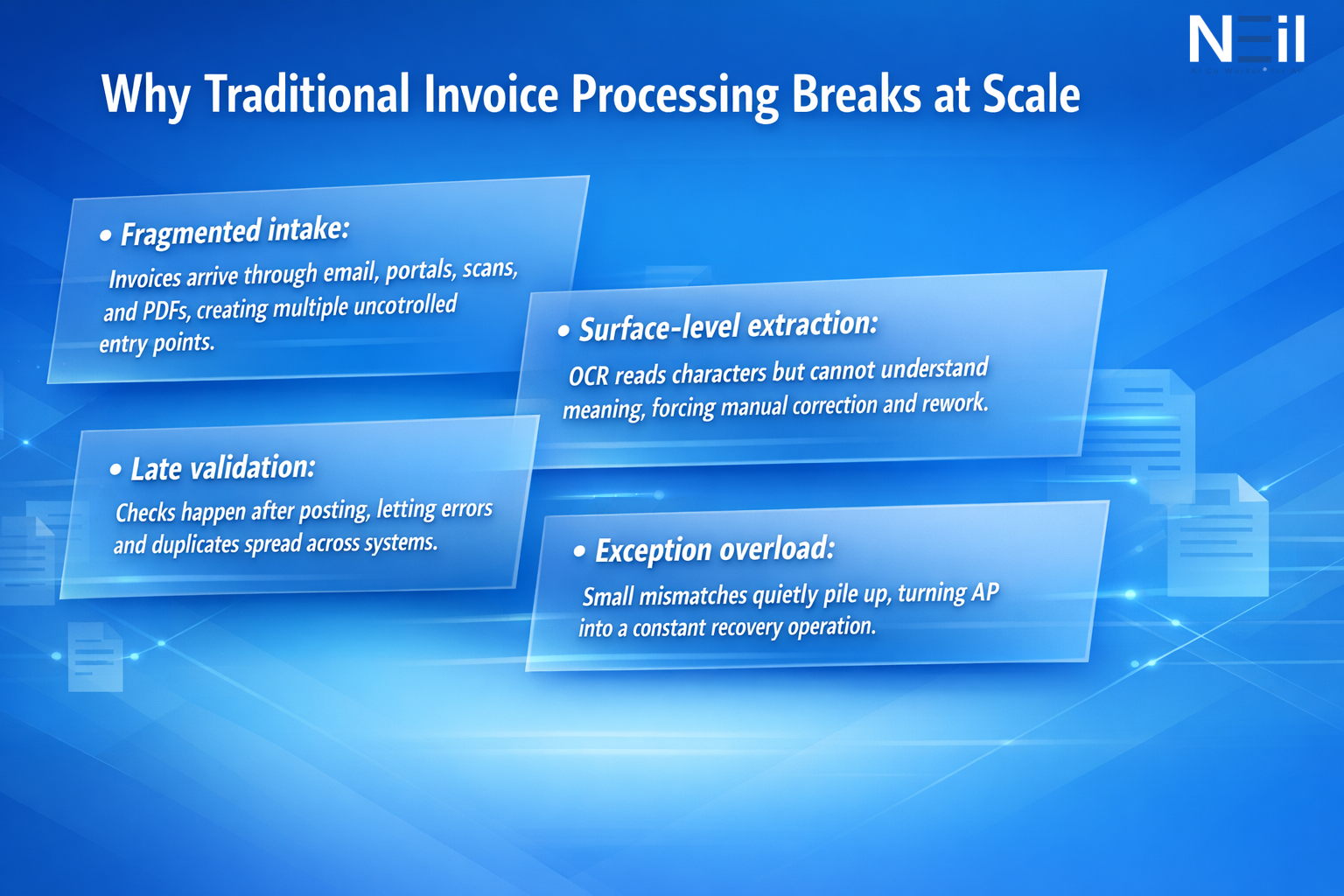

Challenges of Traditional Invoice Processing in Accounts Payable

Manual invoice processing creates inefficiencies that plague finance operations. When AP teams manually extract data from invoices, they’re introducing systematic errors into financial records.

Traditional invoice processing struggles with format inconsistency. Vendors submit invoices through various channels like email attachments, postal mail, supplier portals, and handwritten notes. Legacy optical character recognition systems achieve less accuracy on complex documents, leaving AP teams to manually correct thousands of errors monthly.

Without automated systems, supplier inquiries become a significant drain on AP resources. Each rejected invoice requires investigation, correction, and resubmission. Work that generates zero value. The average invoice takes 10-20 days to process through manual workflows, delaying payment decisions and reducing financial agility.

The Evolution Toward Invoice Processing Automation

From Paper-Based Workflows to Digital-First AP

The evolution of invoice processing mirrors broader digital transformation trends across finance functions. The journey began with simple digitization, scanning paper invoices and storing them electronically. While this reduced physical storage requirements, it did little to address the fundamental inefficiency of manual data entry.

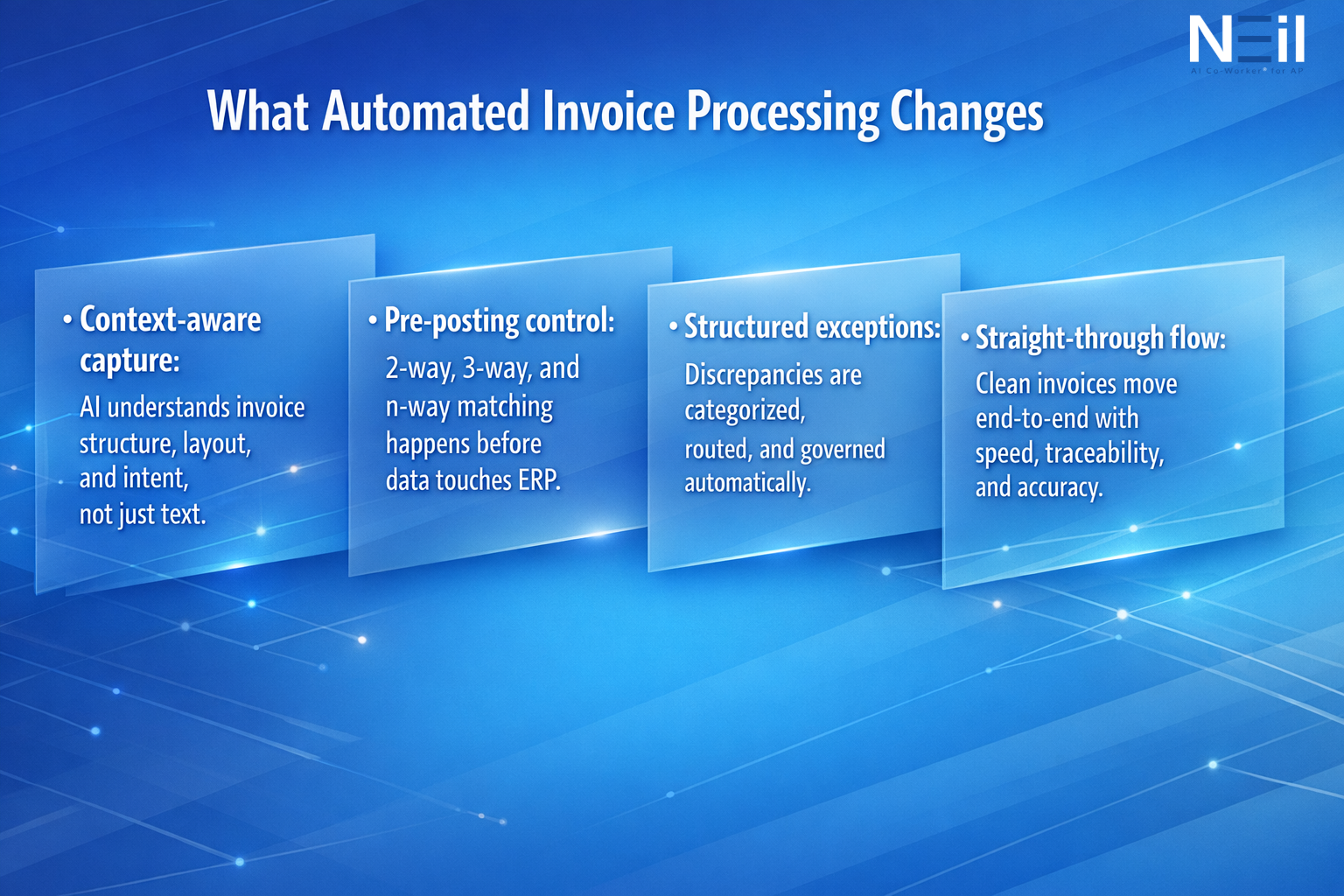

The current evolution represents a quantum leap beyond simple digitization. Neil, our AI Co-worker for Accounts Payable leverage AI, ML, and advanced intelligent character recognition to eliminate manual touchpoints entirely. He can automatically capture invoices from any channel, extract relevant data with over 95% accuracy, validate information against purchase orders and contracts, route documents for approval, and post to accounting systems, all without human intervention for routine transactions.

Why Invoice Process Automation Is No Longer Optional

Market dynamics have transformed automated invoice processing from a nice-to-have technology into a business necessity. Global e-invoicing mandates are proliferating rapidly, with over most of the countries now enforcing or actively considering e-invoice requirements. Organizations without automated invoice validation systems face mounting regulatory risks and potential penalties.

Attracting qualified accounting professionals to perform repetitive data entry has become nearly impossible. Automation enables organizations to deploy scarce talent toward strategic activities rather than transactional processing. Companies that delay automation find themselves at increasing disadvantage as industry benchmarks shift toward touchless processing.

A Technical Deep Dive into Automated Invoice Processing

Modern automated invoice processing operates through sophisticated orchestration of multiple technologies. The process begins when an invoice enters the organization through any channel like email, supplier portal, electronic data interchange, or paper mail. The system captures data from incoming invoices using ICR technology that extracts data from scanned documents or images.

Neil analyzes captured documents to identify and extract relevant fields. Unlike template-based systems requiring configuration for each vendor format, Neil uses machine learning to recognize fields across unlimited invoice variations. It validates extracted data against purchase orders and goods receipts already in the ERP system, checking for discrepancies and flagging mismatches for review.

Once validated, invoices are automatically routed through predefined approval workflows based on business rules. After receiving necessary approvals, invoice data posts automatically to the ERP system. Once approved, payments are scheduled and recorded in the ERP system, updating financial reports and records in real time.

AI-Driven Invoice Capture and Data Extraction

Our AP Automation solution like Neil can achieve greater than 99 percent accuracy on complex documents compared to approximately 80 percent with traditional OCR systems. This accuracy improvement stems from deep learning models trained on millions of invoice examples, enabling systems to recognize patterns and structures that rule-based approaches cannot detect.

It first analyzes document structure, identifying regions likely to contain specific information types, then interprets extracted text, understanding context and relationships between data elements. It continuously learn from historical invoice data to improve accuracy and decision-making within processing workflows, identifying trends, detecting anomalies, and adapting to new invoice formats over time.

Invoice Authentication and Compliance at Scale

PO Matching and Validation

Neil executes three-way matching instantaneously and with perfect consistency. It validates an invoice by cross-referencing three independent documents to ensure organizations are paying for goods and services actually ordered and received. The system compares line-item details including quantities, unit prices, and descriptions, flagging any discrepancies for investigation. Minor variances within acceptable thresholds can be automatically approved, while significant discrepancies trigger exception workflows. For non-PO invoices, intelligent systems leverage historical data to predict appropriate general ledger coding and approval routing.

Fraud Prevention Using AI-Powered Analysis

Beyond duplicate detection, comprehensive fraud prevention requires analyzing multiple data points and identifying subtle patterns indicating fraudulent activity. AP automation solutions track changes to vendor banking information, flagging modifications for verification before processing payments to new accounts. Invoice pattern analysis identifies submissions deviating from established vendor norms, with machine learning models continuously refining detection algorithms based on confirmed fraud cases.

Omnichannel Invoice Processing and Vendor Experience

Supporting Suppliers Across Geographies

Global organizations face unique challenges managing suppliers across multiple countries. NLP models trained on multilingual datasets accurately extract data from invoices in dozens of languages, automatically translating content for internal approvers when necessary. Currency handling becomes seamless with intelligent systems that recognize and convert amounts according to current exchange rates. Regional compliance requirements integrate directly into processing workflows, ensuring regulatory compliance without requiring AP staff expertise in international tax regulations.

Reducing Communication Gaps

Modern systems address communication gaps through supplier portals providing real-time visibility into invoice status. Suppliers can log in to view submission confirmation, validation status, approval progress, and expected payment dates. This self-service capability dramatically reduces inquiry volumes while improving supplier satisfaction. Automated notifications keep suppliers informed throughout the processing lifecycle. When discrepancies arise, the system can automatically request clarification or corrections from vendors through the portal, enabling faster resolution without email chains or phone tag.

Strengthening Vendor Relationships Through Automation

Suppliers value predictability, transparency, and timely payment. Consistent payment performance builds trust and improve commercial terms. Vendors confident in receiving timely payment may offer better pricing, extended payment terms, or priority service during supply constraints. Data-driven vendor management improves through analytics enabled by automated processing, with organizations gaining visibility into vendor performance metrics including invoice accuracy and dispute frequency.

The Role of Straight-Through Processing in the Future of AP

Straight-through processing (STP) with AI-led automated invoice processing transforms the entire invoicing cycle by creating a robust automated system that seamlessly handles tasks from receipt to payment without human intervention. Employing highly trained AI algorithms, this system efficiently extracts crucial data from invoices, including vendor details, amounts, and payment deadlines, with unparalleled accuracy. The integration of AI streamlines validation and approval workflows, facilitating swift and error-free processing while significantly reducing the time and resources traditionally required for invoice management. This transformative approach not only enhances operational efficiency but also minimizes errors, resulting in substantial cost savings and heightened financial transparency for organizations.

Conclusion

The future of accounts payable is decisively touchless, intelligent, and strategic. As AI-led automation matures beyond simple data extraction to autonomous decision-making, finance teams are shifting from transaction processing to value creation. By 2026, Gartner predicts that 90 percent of finance functions will deploy AI-enabled solutions, with straight-through processing rates reaching 80-95% in best-in-class organizations. This evolution transforms AP from a cost center into a strategic function that optimizes cash flow, strengthens vendor relationships, and generates actionable financial intelligence.

Automated invoice processing represents the foundational layer for this transformation. Organizations implementing intelligent automation today aren’t just reducing costs, they’re building the capabilities required for competitive survival in an increasingly digital economy. The data generated through automated workflows feeds predictive analytics, enables real-time fraud detection, and supports strategic initiatives like dynamic discounting and working capital optimization. As systems evolve from reactive processing to proactive recommendation engines, AP teams transition from manual data entry to strategic analysis, vendor management, and financial planning.

The question facing organizations is no longer whether to automate invoice processing, but how quickly they can implement systems positioning them for the future of finance. As touchless operations become the standard expectation and AI capabilities advance toward full autonomy, delayed adoption creates compounding competitive disadvantages. Organizations embracing automated invoice processing now are laying the groundwork for intelligent finance ecosystems that will define industry leadership in the years ahead.

To kickstart your finance automation journey, connect with us at neil.e42.ai or write to us at interact@e42.ai

FAQs

Automated invoice processing uses AI, machine learning, and ICR technology to handle invoices from receipt through payment without manual intervention. The system automatically captures invoices, extracts data with over 99 percent accuracy, validates against purchase orders, routes for approval, and posts to accounting systems—eliminating manual data entry entirely.

Straight-through processing means invoices flow from supplier submission to payment without manual intervention. Best-in-class organizations achieve 65-95% STP rates. AI systems enable higher rates by learning continuously and handling variations that would trigger exceptions in rule-based systems.

AI prevents fraud through pattern analysis identifying unusual invoices, fuzzy matching algorithms detecting duplicates, vendor master data monitoring flagging banking changes, and three-way matching verifying purchase orders against receipts and invoices. Organizations report catching duplicates worth tens of thousands in the first months.

Yes, modern solutions integrate seamlessly with SAP, Oracle, Microsoft Dynamics, NetSuite, and other major ERP platforms. API-based integrations enable bidirectional data flow with pre-built connectors that significantly reduce implementation complexity and time.