Invoice processing in Accounts Payable is like a potential minefield. A single error can detonate into costly overpayments, late fees, or even regulatory breaches. For many businesses, this is the harsh reality of manual Accounts Payable. The process is slow, error-prone, and a constant drain on resources. Invoice processing automation addresses these risks by embedding automated validations into Accounts Payable workflows, ensuring accuracy and compliance from the outset.

According to the 2024 AFP Payments Fraud and Control Survey, 79% of organizations reported being targets of attempted or actual payments fraud, marking a 15-percentage point increase from the previous year. In addition to the risk of fraud, manual Accounts Payable processes often lead to inefficiencies that can hinder a company’s financial health. Delays in processing invoices can result in missed early payment discounts and strained supplier relationships. Furthermore, the lack of real-time visibility into outstanding liabilities can complicate cash flow management and financial forecasting.

By leveraging Neil, our AI Accounts Payable automation solution, businesses can transform their AP departments from units to strategic profit centers. Such software can accurately extract data from invoices, verify information against purchase orders and contracts, and automatically route documents for approval. This results in accelerated processing times, reduced errors, and improved cash flow.

What is Invoice Processing in Accounts Payable?

Accounts Payable involves the systematic handling of incoming invoices to ensure accurate and timely payment to suppliers. This includes invoice receipt, invoice validation, verification against purchase orders, compliance checks, approvals, and posting into ERP systems. Effective invoice processing is essential for maintaining good vendor relationships and efficient cash flow management.

Modern invoice processing automation replaces manual checks with automated validations, ensuring every invoice meets predefined business and compliance rules before payment authorization. This approach strengthens vendor trust, improves audit readiness, and supports scalable AP automation.

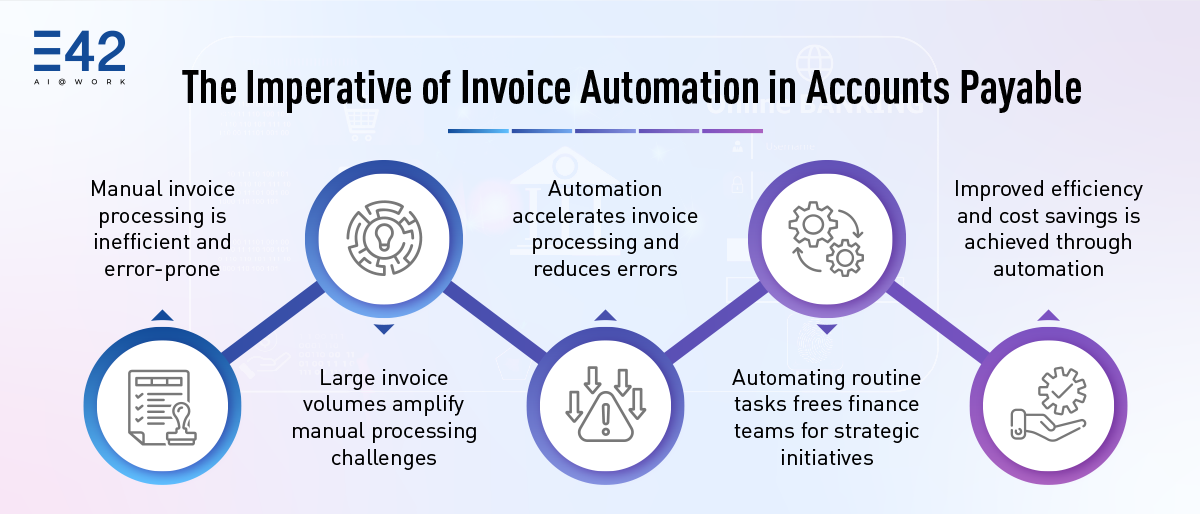

Why Invoice Processing Automation Is Critical for Accounts Payable

Manual validations and operations in invoice processing are inherently limited, especially when dealing with large volumes of invoices. Human errors are inevitable, leading to inaccuracies that can disrupt financial reporting and compliance. Invoice processing automation addresses these limitations by applying automated validations consistently across every invoice.

It enables finance teams to handle thousands of invoices with speed and precision, significantly reducing manual effort. Neil, AI co-worker for AP, supports AP teams by automating repetitive validations and surfacing only true exceptions—allowing humans to focus on decisions that require judgment.

Automated Validation Processes and Operations

Automated validation processes significantly enhance quality assurance by utilizing advanced algorithms to identify and correct errors and inconsistencies. This method not only boosts efficiency but also minimizes human error and ensures adherence to industry standards. By automating repetitive tasks, teams can dedicate more time to strategic activities, thereby improving overall productivity and reliability. This streamlined approach ultimately leads to higher quality outcomes and more robust operational performance. Here is a breakdown of how it happens:

Invoice Data Validation

Accounts payable automation solutions like Neil excel in validating key invoice data, ensuring accuracy and compliance from the outset. These systems can verify details such as vendor information, item descriptions, tax calculations, and amounts. By cross-referencing this data with internal databases and external sources, automation ensures that only accurate and compliant invoices proceed through the workflow.

For instance, invoice processing automation performs entry-level validations including checking for duplicates, verifying extracted data, and ensuring data formats meet ERP requirements. Automated systems also handle multiple currencies accurately, converting them as per the relevant exchange rates.

Post Extraction Steps

After initial data extraction, Neil performs additional validations and data derivations. These include:

- Derivation of Additional Field Data: Automation can derive necessary data fields, such as General Ledger (GL) codes, from predefined rules

- Currency Conversion: Using APIs, automated systems can convert transaction currencies to home currencies

- Data Feeding: The validated and enriched invoice data is fed into the accounting system, incorporating GL codes, cost centers, and other necessary details

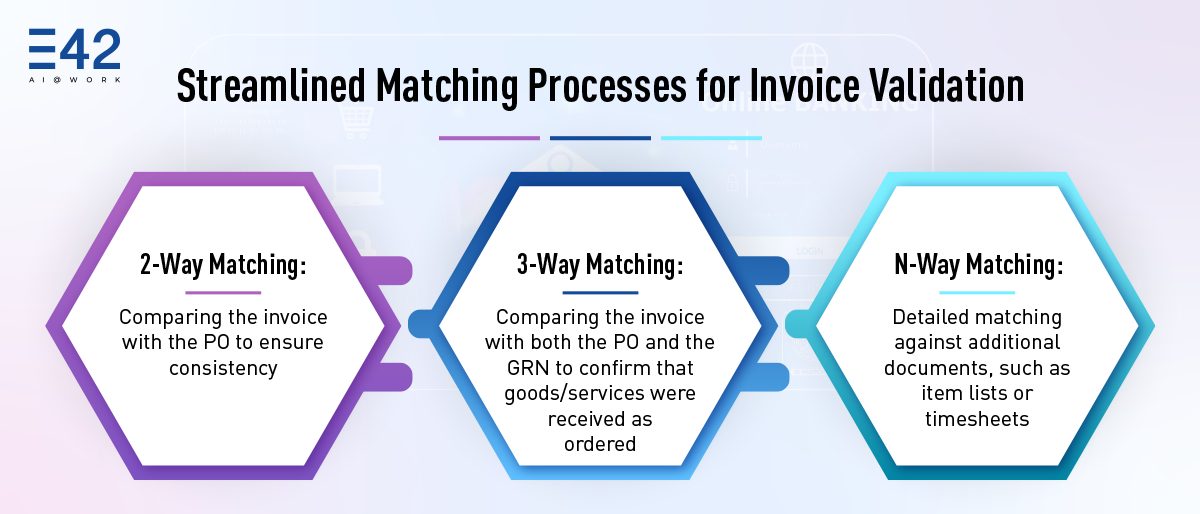

2-Way, 3-Way, N-Way Matching

One of the critical aspects of invoice validation is matching invoices against purchase orders (POs) and goods receipt notes (GRNs). Automated systems facilitate:

- 2-Way Matching: Comparing the invoice with the PO to ensure consistency

- 3-Way Matching: Comparing the invoice with both the PO and the GRN to confirm that goods/services were received as ordered

- N-Way Matching: Further detailed matching against additional documents, such as item lists or timesheets, to ensure comprehensive validation

Automated invoice matching ensures payment accuracy while reducing manual checks in Accounts Payable automation.

Exception Handling

Despite strong validations, exceptions still occur. Invoice processing automation identifies discrepancies such as pricing mismatches or missing data and routes them through structured exception handling workflows.

Neil, AI co-worker for AP, supports configurable maker-checker workflows, ensuring that exceptions are reviewed efficiently while maintaining governance within AP automation.

Automated invoice processing software are adept at identifying and handling exceptions, significantly reducing the need for manual intervention. When discrepancies arise, the system flags these exceptions for review. This might include discrepancies in amounts, missing details, or mismatches in data. Exception handling workflows can involve multi-level authorization (maker-checker) to ensure that only validated exceptions proceed.

Benefits of Automated Validations and Operations

Efficiency Gains: With invoice processing automation, organizations can process invoices faster, reduce approval cycle times, and lower operational costs. This efficiency directly improves productivity across finance teams.

Accuracy Improvement: End-to-end automated validations drastically reduce data entry errors, duplicate payments, and mismatches. By embedding invoice validation and automated invoice checks at every stage, automated invoice processing improves financial accuracy, strengthens compliance, and supports better decision-making.

Scalability: Automation provides the scalability needed to handle increased invoice volumes without a proportional increase in resources. This scalability is crucial for growing businesses that need to manage expanding operations efficiently.

Entry-Level Validations: These systems perform essential entry-level validations, including checking for duplicates, validating vendor and item details, and ensuring data formats meet ERP requirements. These initial checks lay the foundation for accurate invoice processing.

Post Extraction Steps: Post extraction, Neil derive additional field data, convert currencies, and feed enriched data into the accounting system. These steps ensure comprehensive validation and accurate financial reporting.

Workflow Configuration: AI allows for configurable workflows, including multi-level authorization (maker-checker) and exception handling. These configurations ensure that every invoice undergoes appropriate scrutiny before approval.

Auto-Response Capability: Neil can acknowledge the receipt of invoices and communicate with vendors regarding missing or incorrect details. This improves vendor communication and reduces delays in invoice processing.

Conclusion

The transformation of invoice processing automation is reshaping how Accounts Payable functions operate. By leveraging advanced technologies like AI and ML, businesses can achieve unprecedented levels of efficiency, accuracy, and scalability. Automated systems streamline every aspect of the AP process, from initial data validation to payment processing, ensuring that businesses maintain healthy cash flows and compliance.

Kickstart your finance automation journey and ensure robust invoice validation with us!

Invoice processing automation refers to the use of intelligent software to automatically capture, validate, match, and route invoices within Accounts Payable. It replaces manual data entry and checks with automated validations, improving accuracy, speed, and compliance across AP workflows.

Automated validations apply predefined business rules and AI-driven checks to verify invoice data such as vendor details, tax calculations, quantities, and totals. In invoice processing automation, these validations reduce human error, detect duplicates early, and ensure invoices meet policy and regulatory requirements before payment.

Invoice processing automation supports 2-way, 3-way, and N-way invoice matching. In Accounts Payable automation, invoices are matched against purchase orders, goods receipt notes, and supporting documents to confirm that goods or services were received as billed.

When discrepancies arise, invoice processing automation flags them through structured exception handling workflows. Systems route exceptions for review using maker-checker or multi-level approvals, ensuring control while minimizing manual follow-ups in AP automation.

Neil supports invoice processing automation by validating invoices, assisting with invoice matching, managing exceptions, and guiding AP teams, and augmenting human decision-making rather than replacing it.

Yes. One of the key benefits of invoice processing automation is scalability. Automated systems can process increasing invoice volumes without additional headcount, making them ideal for growing organizations and shared services environments.

Automated invoice processing improves vendor relationships by ensuring faster acknowledgements, timely payments, and clear communication around missing or incorrect invoice data. This transparency reduces disputes and strengthens supplier trust within Accounts Payable automation.