Technology has evolved beyond measures in the past few decades. In order to survive the cut-throat competition, businesses must embrace what’s new in tech. It’s also essential for them to be flexible enough to make the most out of the innovation it brings. Automation and artificial intelligence (AI) are at the forefront of this technological revolution. Implementing AI-powered automation can streamline various aspects of a business process. It can enhance customer experiences, ensure error-free data processing, and address issues such as attrition. By leveraging AI for business process automation, organizations can overcome persistent challenges that hinder growth.

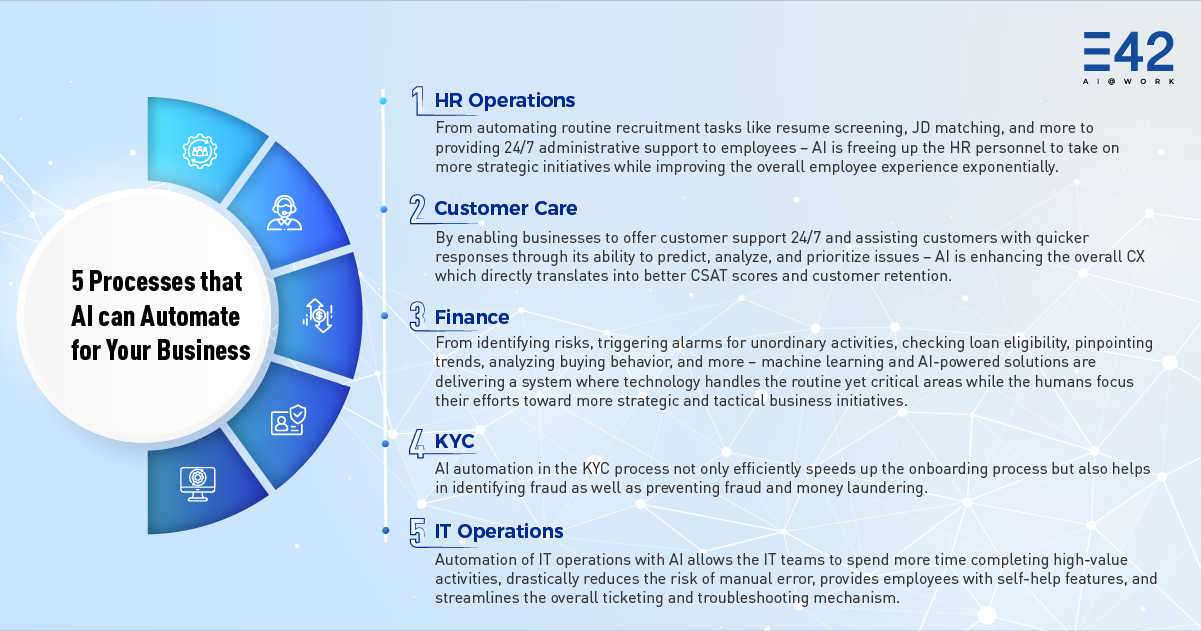

Here are some of the business processes that can be streamlined with AI powered automation:

HR Process Automation:

HR process automation is touching every aspect of the employee lifecycle. From recruitment to onboarding, employee welfare and engagement, to L&D, AI is playing a vital role. Major HR processes now have AI-based conversation models integrated into them. This means that issues can be anticipated, evaluated, and diagnosed in real-time, enabling HR teams to make better decisions.

In terms of recruitment, AI for business process automation can streamline various HR operations. These include resume screening, matching candidates with job descriptions, and conducting initial interviews. Moreover, it offers round-the-clock administrative support to employees and ensures their well-being through continuous engagement efforts. As a result, HR personnel can focus on strategic initiatives while improving the employee experience.

Importance of AI for Business Process Automation in Customer Service

Customer service is a major expense and a driver of customer experience. It’s a defining factor for customer retention and brand loyalty. Therefore, it’s one of the key areas where AI and automation can fit right in.

Enterprise process automation solutions can enhance the overall consumer experience by leaps and bounds. By implementing AI-led automation in customer support, businesses can offer support even outside business hours. These AI-led business processes automation solutions can also assist customers with quicker and more accurate responses by predicting, analyzing, and prioritizing issues. This results in better CSAT scores and customer retention.

What’s more? The data-driven analytical insights that the right implementation of AI automation in customer service brings can be further used to enhance the product or service!

Importance of AI-led Automation in Business Processes for Finance Industry

Two of the most significant uses of automation in accounting and finance are:

- Freeing humans for more strategic tasks.

Many businesses have adopted AI for automation of business processes. This includes automating routine finance tasks like data entry, transaction processing, and compliance. However, adoption is picking up pace now. More leaders now realize the ROI of implementing AI in finance tasks like AP and AR processes.

However, fraud is a critical issue for financial institutions. In 2020, banks paid over $10 billion in fines for fraud-related violations. Enterprise process automation solutions can make a significant difference in addressing this issue. From identifying risks, triggering alarms for unordinary activities, checking loan eligibility, analyzing buying behavior, and much more – the potential of AI powered solutions is endless. These solutions create a system where technology handles routine yet critical tasks, freeing up humans to focus on strategic and tactical business initiatives.

Need of KYC Automation

Verifying and assessing each customer’s identity and eligibility can be tedious for enterprises in the BFSI sector. Human errors in the process can cause delays. This results in disgruntled clients and an unfavorable customer experience. Enterprise automation solutions can make the KYC process more efficient, accurate, and cost-effective. With ML, NLP, and other groundbreaking technologies, there has been an immense rise in the cognitive capabilities of AI-powered solutions (RPA to CPA). These solutions are configured and trained to act, think, and learn like humans. They process documents with ICR/OCR functionalities and extract pertinent information like a human agent. AI-led automation in KYC not only speeds up the onboarding process but also identifies and prevents fraud and money laundering.

Use of AI in Business Process Automation for the IT Sector

IT teams are entrusted with multiple tasks. Some of these tasks include setting up accounts of newly onboarded employees, granting the required access and permissions, and dealing with the influx of other IT-based issues. Enterprise automation solutions enable businesses to manage complex and tedious tasks without human intervention. This frees up the IT team to focus on high-value activities, reduces the risk of human error, and provides employees with self-help features. Additionally, AI streamlines the ticketing and troubleshooting process, enhancing the overall efficiency of the IT industry.

Unlock the power of intelligence with E42 AI co-workers

Conclusion

According to reports, AI can potentially add close to $16 trillion to the global economy by 2023. This statement is self-explanatory. AI-led automation for business processes is giving enterprises across industries all the reasons they seek to invest in and embrace technology. It offers higher accuracy, reliability, enhanced customer experience, and massive cost savings. AI-led automation is making strides across enterprise functions. From customer service to HR to sales and marketing to finance, it frees up the human workforce for more strategic initiatives while ensuring a better experience for all stakeholders – employees and customers alike.

Make your enterprise intelligent with E42!

E42 is a no-code Cognitive Process Automation (CPA) platform to create AI co-workers that automate business processes across functions at scale. Each AI co-worker can be customized with specific features to address particular problem areas in any industry or vertical. At the core of every AI co-worker’s configuration is the ability to think like humans, understand user sentiments, take action based on those sentiments, and learn from every interaction. AI co-workers can be used independently to automate specific processes. Or they can be combined to provide process-agnostic automation to an enterprise. To start your automation journey, get in touch with us at interact@e42.ai today!