Table of Contents

Introduction to AI in Accounts Payable

The Accounts Payable (AP) function has long been viewed as a back-office necessity—a cost center bogged down by manual processes, paperwork, and inefficiencies. However, with the rise of AI in Accounts Payable, this perception is rapidly changing.

Artificial intelligence (AI) and machine learning in Accounts Payable are revolutionizing how businesses manage invoices, payments, and financial workflows. By leveraging AI for Accounts Payable, companies can automate repetitive tasks, reduce human errors, and gain real-time financial insights—transforming AP from a transactional burden into a strategic financial function.

This blog post explores how AI and Accounts Payable automation is reshaping financial operations, the key technologies driving this change, and the tangible benefits businesses can expect.

Challenges of Traditional Accounts Payable Processes

Traditional Accounts Payable operations represent a significant drain on organizational efficiency and financial control that most companies fail to properly quantify. The reliance on manual processing creates a cascade of operational challenges that extend far beyond simple inefficiency. At the core lies the fundamental issue of human error in data entry—a problem that manifests not just in occasional mistakes, but in systemic inaccuracies that distort financial reporting and vendor relationships. Studies across industries reveal that manual invoice processing typically contains error rates between 5-10%, with each mistake triggering a costly correction cycle that can take 3-5 business days to resolve.

The approval workflow bottlenecks in traditional AP systems create equally severe financial consequences. Paper-based processes force unnecessary delays, with the average invoice approval taking 12-15 days in manual systems compared to hours in automated environments. This latency carries tangible costs – from missed early payment discounts to strained supplier relationships that may result in less favorable terms. More critically, the lack of real-time visibility into payables creates blind spots in cash flow management, preventing treasury teams from optimizing working capital or accurately forecasting short-term liquidity needs.

Perhaps most dangerously, manual AP processes expose organizations to substantial compliance and fraud risks. Without automated controls, duplicate payments and fraudulent invoices slip through at alarming rates—industry data suggests over 1% of all invoice payments are duplicates. The lack of digital audit trails also makes compliance with evolving tax regulations and financial reporting standards increasingly difficult to maintain. In an era of heightened financial scrutiny, these manual control gaps represent unacceptable governance risks.

The Role of AI in Accounts Payable Transformation

AI in finance and accounting is no longer a futuristic concept—it’s a present-day reality. Here’s how AI is transforming AP:

- Automated Invoice Processing: AI-powered intelligent invoice processing extracts data from invoices (PDFs, scanned copies, emails) with high accuracy, eliminating manual entry

- Smart Matching & Approvals: AI cross-references invoices with purchase orders (POs) and contracts, flagging discrepancies for review

- Predictive Cash Flow Management: By analyzing historical data, AI predicts payment due dates, helping businesses optimize working capital

- Fraud Detection & Compliance: AI algorithms detect anomalies, duplicate invoices, and non-compliant transactions, reducing financial risks

This shift towards Accounts Payable process automation is helping businesses improve efficiency, reduce costs, and enhance financial decision-making.

Key AI Technologies in Accounts Payable

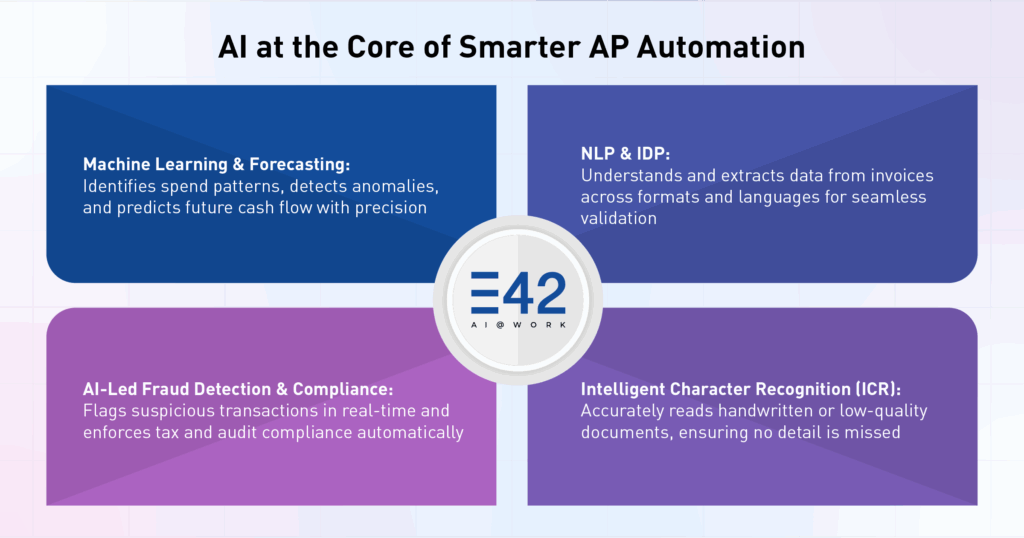

Modern Accounts Payable automation leverages four core artificial intelligence technologies that work in concert to transform financial operations. These systems combine machine intelligence with financial expertise to deliver unprecedented efficiency, accuracy, and strategic insights.

1. Machine Learning & Predictive Analytics

Advanced machine learning algorithms in Accounts Payable continuously analyze invoice data to optimize expense categorization, detect anomalies, and forecast cash flow needs. These systems learn organizational spending patterns to improve accuracy while identifying payment optimization opportunities and potential fraud indicators.

2. Natural Language Processing (NLP) & Intelligent Document Processing (IDP)

Sophisticated NLP engines extract and interpret invoice data regardless of format or language with contextual understanding. IDP frameworks process complex documents while maintaining relationships between purchase orders, invoices, and receipts for automated validation.

3. Intelligent Character Recognition (ICR)

Specialized ICR technology accurately deciphers poor-quality scans and handwritten documents that challenge conventional OCR systems. These solutions handle smudged or distorted text while validating extracted data against known patterns to ensure reliability.

4. AI-Powered Fraud Detection & Compliance

Continuous monitoring systems establish vendor behavior baselines to flag suspicious activities and potential duplicates. Real-time compliance engines automatically apply current tax regulations while maintaining complete audit trails of all processing decisions.

End-to-End AP Automation: The Future of Invoice Processing

Modern Accounts Payable is undergoing a radical transformation through complete workflow automation. By digitizing the entire AP lifecycle—from invoice receipt to reconciliation—organizations are achieving unprecedented efficiency and accuracy.

The automation journey begins with intelligent invoice capture, where AI-powered OCR technology extracts data with over 90% accuracy while validating information against ERP records. This eliminates manual data entry errors and processes invoices in seconds rather than days. The system then dynamically routes invoices through smart approval workflows, adapting to organizational hierarchies and historical patterns to reduce approval cycles from weeks to hours.

Seamless integration with major ERP platforms like SAP, Oracle, and NetSuite ensures real-time synchronization, maintaining accurate financial records while eliminating reconciliation headaches. The process culminates in optimized payment execution, where AI schedules payments based on cash flow forecasts and discount opportunities, automatically reconciling with bank statements across all payment methods including ACH, virtual cards, and international wires. This end-to-end approach enables true touchless processing, with over 85% of invoices flowing through without human intervention.

Straight-Through Processing: The AP Gold Standard

If you’re wondering what metrics to consider when selecting the best AP automation solution for your enterprise, look no further than Straight-Through Processing (STP).

Straight-Through Processing represents the pinnacle of AP automation, where invoices progress from receipt to payment without human touch. The journey begins as invoices are captured through multiple digital channels—email, supplier portals, or EDI connections—before advanced AI extracts all critical data fields with contextual understanding that goes beyond simple pattern recognition.

The system performs intelligent three-way matching against purchase orders and goods receipts, automatically resolving minor discrepancies while flagging significant variances for review. Approved invoices proceed to payment through the organization’s preferred method, with all transactions automatically recorded in the accounting system. The transformation is profound: paper bottlenecks disappear as 100% digital processing enables minute-level cycle times compared to traditional manual processes that took days or weeks. Error rates plummet to near-zero levels from the traditional 5-10% ranges, while every transaction maintains a complete digital audit trail for compliance and reporting.

Benefits of AI in Accounts Payable for Businesses

- Significant Cost Reductions: Organizations achieve 40-60% lower processing costs through reduced labor needs and eliminated late payments. AI systems also identify and capture early payment discounts that were previously missed due to manual processing delays.

- Dramatic Process Acceleration: Invoice approval cycles shrink from days/weeks to hours/minutes, creating working capital advantages. This acceleration strengthens supplier relationships through predictable, timely payments and improved communication.

- Enhanced Accuracy and Compliance: AI reduces human errors in data entry while automatically validating tax calculations and contractual terms. For regulated markets like India, systems ensure proper GST treatment and maintain complete digital audit trails for compliance.

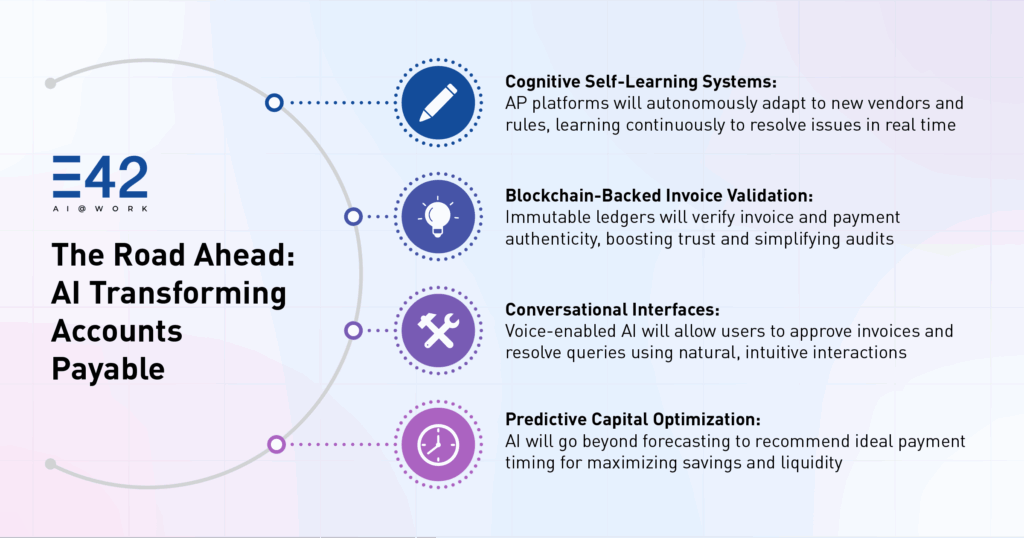

Future of AI in Accounts Payable: What Lies Ahead?

- Self-Learning Cognitive Systems: Future AP platforms will develop true understanding of organizational ecosystems, automatically adapting to new suppliers and regulations without manual updates. Continuous learning will enable proactive exception resolution and process optimization.

- Blockchain-Verified Transactions: Distributed ledger technology will provide immutable verification of invoice authenticity and payment status. This creates unprecedented trust in B2B transactions while simplifying audit processes.

- Conversational AI Interfaces: Voice-activated assistants will enable natural language interactions for payment queries, invoice approvals, and discrepancy investigations. These interfaces will make AP systems more accessible across organizational roles.

- Predictive Working Capital Management: Advanced analytics will evolve from forecasting to prescriptive recommendations for cash optimization. Systems will suggest ideal payment timing balancing discounts, relationships, and liquidity needs.

Conclusion: The AI Revolution in Accounts Payable

Automated invoice processing transcends mere technological advancement; it signifies a transformative shift. In this seamlessly integrated automated system, every aspect—from invoice capture and authentication to omnichannel presence and STP—works harmoniously to create a robust and secure AP framework. Acting as a facilitator rather than a conductor, AI-led automation addresses practical challenges, strengthens vendor relationships, and delivers unparalleled efficiency and accuracy. As businesses adopt this technological evolution, they can confidently position themselves on the stage of financial excellence, shedding the constraints imposed by traditional, manual processes.

To kickstart your finance automation journey, write to us at interact@e42.ai!

Frequently Asked Questions

How does AI reduce errors in Accounts Payable?

AI eliminates manual data entry through automated extraction and validation, reducing human errors by over 90%. Machine learning continuously improves accuracy by learning from corrections.

What are the cost benefits of AI-driven AP automation?

Businesses achieve 40-80% cost reductions through lower labor needs, eliminated late fees, and captured early payment discounts. The ROI typically materializes within 6-12 months.

Can AI help small businesses improve their AP processes?

Absolutely – cloud-based AI solutions offer affordable, scalable automation tailored for SMBs. These require minimal IT resources while delivering enterprise-grade capabilities.

How secure is AI-powered AP automation?

Advanced encryption, multi-factor authentication, and real-time anomaly detection create security superior to manual processes. AI actually reduces fraud risks through pattern recognition.

What AI tools are essential for AP automation?

Key solutions include intelligent document processing platforms, cognitive matching engines, and predictive cash flow analytics tools—all available as modular cloud services.