Most enterprises today are eager to leverage the power of automation to improve enterprise functionality. However, in the digital age, security threats are pervasive, making it challenging for businesses to ensure data safety. This is where artificial intelligence (AI) comes into play. Using AI, businesses can analyze documents, automate fraud detection, and manage regulatory compliance–all in real-time. This article will delve deep into the role of AI in enabling fraud prevention and detection across industries.

Understanding Fraud Prevention

Fraud prevention is a common strategy used to identify fraudulent activity. It aims to prevent financial or reputational damage to enterprises. With the boost in online banking, there has been an increase in fraudulent activities. Enterprises face the constant threat of data loss or information leaks, which can be detrimental to their operations. A robust fraud prevention strategy is crucial, especially in finance and banking. In response to this challenge, business owners are turning to artificial intelligence (AI). By harnessing AI, enterprises can detect and prevent cyber fraud, minimizing economic and reputational risks.

Types of Frauds that are Prevalent Today

Any unauthorized transaction an account holder didn’t make or approve is a nuisance to both banks and consumers. Lost cards, ID document forgery, identity theft, and fake identification are common types of payment fraud. These frauds extract valuable information from unsuspecting individuals. With an email, message, phone call, or any other communication channel commonly known as phishing; users are often tricked into revealing information or downloading malware onto their devices. To mitigate these risks, authentication protection methods can be employed. Some of these methods include email verification, whitelisting, blacklisting, or pattern matching. These methods ensure safety control by implementing client-level verification. It requires the completion of submission from both the receiver and the sender, forming a tight-knit security protocol.

The Role of AI in Fraud Prevention and Detection

Through AI, organizations can save considerable effort and time on tracking, monitoring, detecting, and working on fraud prevention and detection.

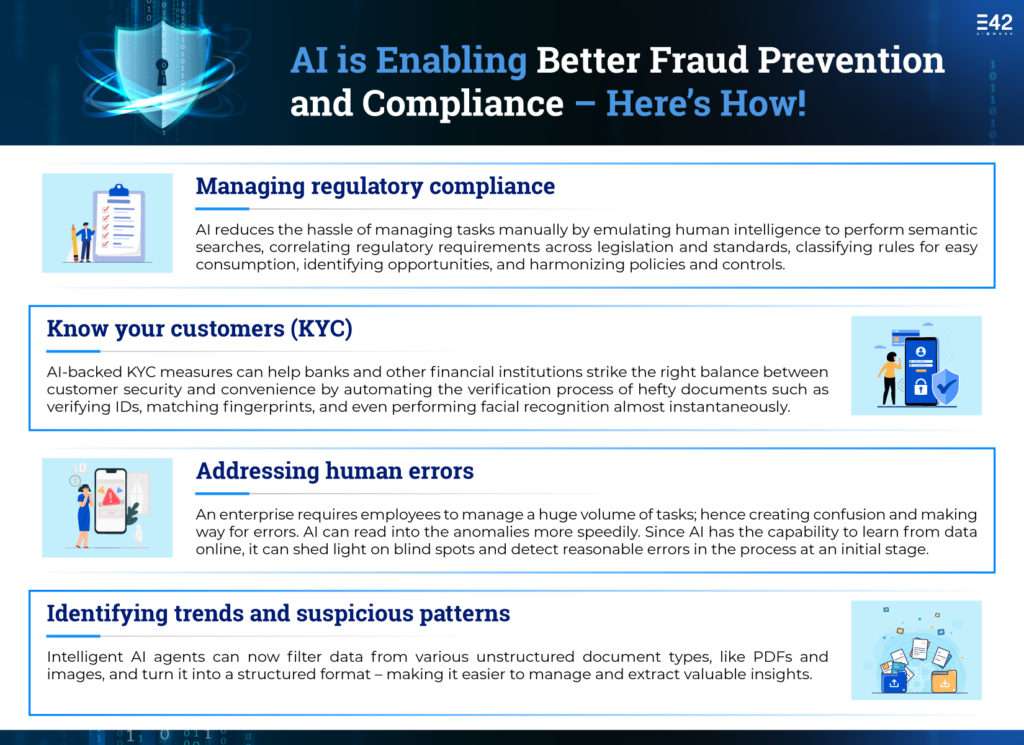

Managing regulatory compliance

Enterprises often encounter numerous false positives from their rule-based compliance alert systems. However, AI in fraud prevention and detection helps in reducing the manual effort required for managing tasks. AI replicates human intelligence, performing various tasks. Some of them include semantic research, correlating regulatory requirements, classifying rules, identifying opportunities, and harmonizing policies and controls. This makes compliance operations more efficient and cost-effective in data-driven environments. Additionally, AI autonomously categorizes compliance-related activities and alerts or updates, events, and activities.

Know your customers (KYC)

AI technology is constantly advancing, becoming more intelligent over time. Its ability to handle and analyze large volumes of data allows it to learn and adapt. AI can play a vital role in the realm of fraud prevention and detection. By implementing AI-backed KYC measures, banks and financial institutions strike a balance between customer security and convenience. These measures automate the verification process for complex documents, such as ID verification, fingerprint matching, and even instant facial recognition. As a result, the risk of fraud is significantly reduced.

Addressing human errors

Human errors cost industries a loss of billions every year. An enterprise requires employees to manage a huge volume of tasks; hence creating confusion and making way for errors. AI, on the other hand, can read into the anomalies more speedily. Since AI has the capability to learn from data online, it can shed light on blind spots and detect reasonable errors in the process at an initial stage. Thus, AI helps in fraud prevention and detection.

Identifying trends and suspicious patterns

Intelligent AI agents can now filter data from various unstructured document types, like PDFs and images, and turn it into a structured format. Thus, making it easier to manage and extract valuable insights. These AI co-workers can use human intelligence to identify suspicious activities. Some of the activities include a massive purchase or an unusual influx of funds in an account. Besides, these AI co-workers aid in fraud prevention and detection by assisting experts in mitigating malicious behavior while reducing security risks and the occurrence of data breaches.

Unlock the power of intelligence with E42 AI co-workers

Benefits of Using AI in Fraud Prevention and Detection

As we know, enterprises have always struggled with fraud prevention, more so with the boom in digital transactions. Today, AI acts as a tool in fraud prevention by early detection of suspicious activities.

Reduced operational risks and expenses

Traditional fraud detection is cumbersome and ineffective in a digital environment. Be it in the banking sector, retail, finance, or marketing, a large volume of data always needs protection. Manual management of such data can be overwhelming. However, the implementation of AI helps in fraud prevention and detection. Intelligent AI co-workers help businesses with real-time monitoring and processing of data. They make it easier to classify, store, and visualize data. Additionally, they can swiftly identify outliers and data anomalies, allowing for immediate action. This ultimately accelerates the detection of fraud and the implementation of preventive measures.

Better customer service and support

AI plays a vital role in fraud prevention and detection. With advancements in machine learning and NLP processes, AI can now interact with customers at a level comparable to humans. Most AI co-workers provide customers with more than just first-level engagement. These AI co-workers can interact with a bulk of customers and provide real-time support, as well as capture instant customer feedback. Leveraging predictive analysis and data-driven recommendations, AI can swiftly detect fraudulent transactions. It then initiates preventive measures to safeguard enterprises. This proactive approach saves enterprises from potential financial losses and protects their reputation.

A centralized account payable process and efficient payment control

Organizations often face digital vulnerability when their accounts payable process is decentralized. This decentralization hampers visibility into payment recipients and creates opportunities for fraud. Automating accounts payable processes enables efficient transfer of invoices through a centralized online method. This automation empowers the accounts team with complete visibility into each payment. They can then utilize AI-powered tools to identify suspicious payment methods and perform necessary verifications before releasing fraudulent payments. Adopting AI can help enterprises in fraud prevention and detection. Organizations can now enhance their accounts payable processes, minimizing vulnerabilities and ensuring secure transactions.

Conclusion

Fraud prevention techniques require changes in how data is stored, organized, and used. The first crucial step in this process is the implementation of artificial intelligence (AI). As technology continues to advance, the threat of fraudulent activities is expected to increase. Thus, AI becomes indispensable in fraud prevention, enhancing customer experience, and fostering loyalty. By significantly reducing human workload and offering swift solutions against fraudulent activities, AI is poised to shape the future of enterprises.

Make Your Enterprise Intelligent with E42

A no-code Cognitive Process Automation (CPA) platform to create intelligent AI co-workers, E42 helps enterprises bring automation to processes across functions. From enhanced customer experience to the generation of insights and analytics for finance and marketing, E42 AI co-workers eliminate human intervention in tasks such as completing payments, controlling expenses, processing, verifying, and reconciling invoices, and several other business processes.

To kickstart your enterprise automation journey, write to us at interact@e42.ai!