The insurance industry is undergoing a digital transformation. However, many companies are still clinging on to traditional paper-based systems. This makes it challenging for employees to process claims quickly and efficiently. As a result, customers are left waiting for hours and feeling frustrated by the slow process.

Advancements in deep learning techniques are constantly pushing artificial intelligence’s (AI) boundaries. It has the potential to mimic human perception, reasoning, learning, and problem-solving skills. When it comes to insurance, AI-led automation will be able to make a huge impact in the insurance claims industry. It will change the current state of ‘detect and repair’ to ‘predict and prevent’. Thus, ushering in a huge transformation in every aspect of how enterprises run their business.

In addition, insurance companies can use Cognitive Process Automation (CPA) technologies to streamline various operational processes. By doing so, they can leverage several benefits. These include enhanced customer experience, reduced fraud, and efficient claim settlement. This article elaborates the importance of AI-led automation in the insurance claims management domain and how it can bring about a massive transformation.

Insurance Claims Management and its Importance

Insurance claims management is responsible for managing all aspects of policyholder claims. This includes right from managing the prospect’s initial contact to the case’s closure. The process involves various stages such as claim assessment, investigation, verification, evaluation, and claims approval.

Efficient claims processing is the backbone of any insurance company. It helps both SMBs and larger corporations develop strategies to manage risks. These include issues such as unscheduled delays, poor planning, and more.

Challenges Faced with Traditional Methods of Insurance Claims Management

The core function of the insurance industry has gotten more complex due to the exponential growth of customer data. Traditional methods of collecting data for insurance claims involve unstructured digital formats or paper documents. Due to the volume and complexity of the data, employees spend a lot of time analyzing it manually. This can be tedious and time-consuming, leading to burnouts from handling large amounts of data manually.

Customers may also be affected by the lengthy and tedious insurance claim process. This can cause significant suffering due to the prolonged period of the procedure. To improve the process, customers look for cost-effectiveness, easy claim filing, and faster claim settlement. These integral aspects can be achieved by implementing AI-led automation in the insurance claims industry.

How does AI-led automation Increase Efficiencies in Insurance Claims Management?

Let’s look at how AI-led automation helps in increasing efficiency in the insurance claims industry!

AI-led Automation Leads to Faster Insurance Claims Settlement

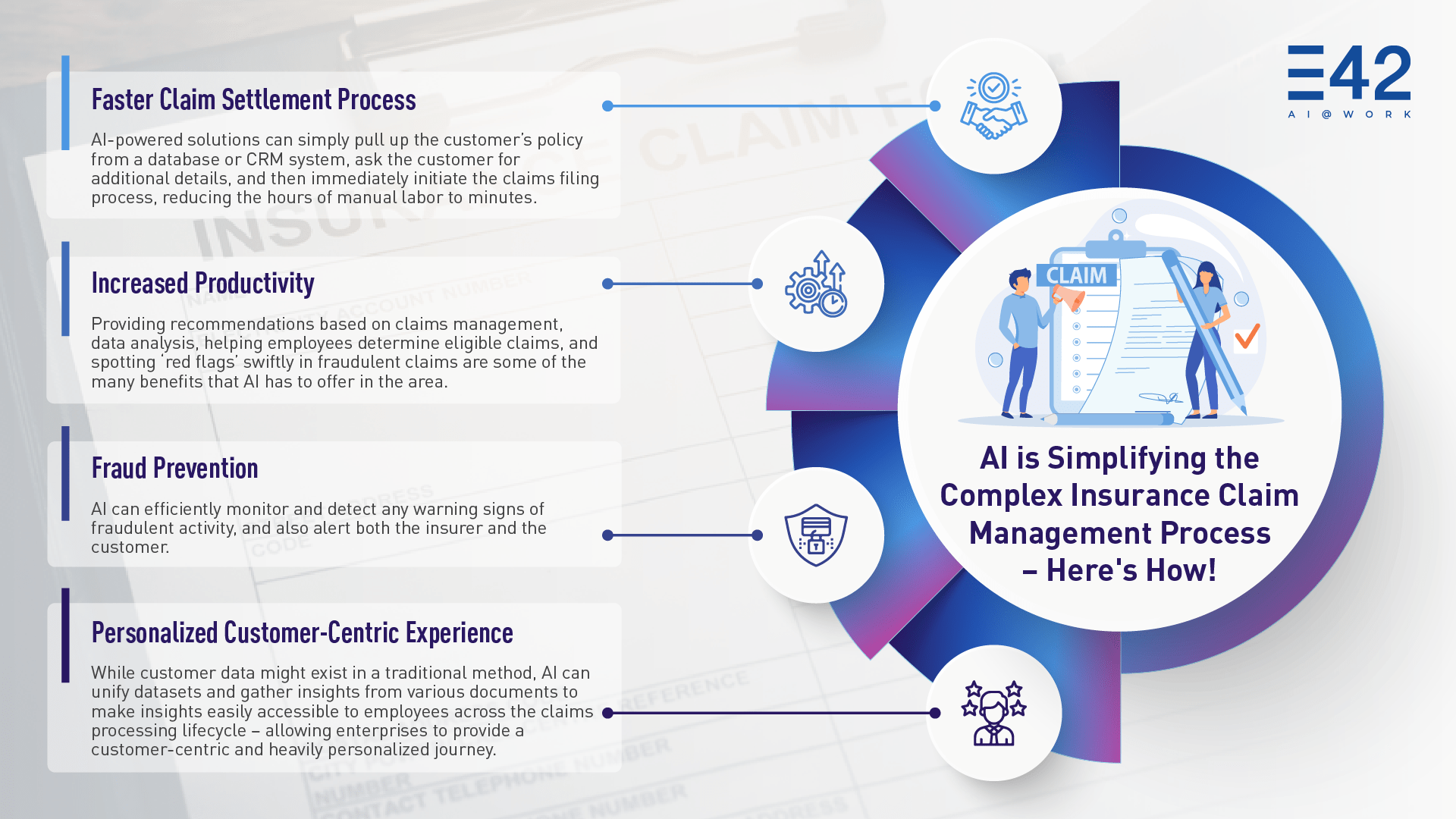

Processing insurance claims requires employees to perform several tasks accurately and efficiently. This is often cumbersome and requires large amounts of data collection and analysis. AI-led automation offers a swifter, and more efficient service in the insurance claims industry, particularly when it comes to filing a claim. These solutions can simply pull up the customer’s policy from a database or CRM system, ask the customer for additional details, and then immediately initiate the claims filing process. Thus, reducing the hours of manual labor to minutes.

AI-led Automation Increases Productivity During Insurance Claims Processing

Implementing AI-powered automation has become crucial in the evolving insurance claims industry. Many service providers have already begun using insurance claims automation to make faster and more accurate data-driven decisions. By automating simple tasks, such as identifying eligible claims and detecting fraud, AI increases employee productivity and reduces workload, allowing them to focus on more complex tasks. This results in better customer experience and higher CSAT scores. As AI technology advances, it is likely that more complex tasks will be automated, further streamlining the claims process.

Use of AI in Fraud Prevention

The use of AI-led automation in insurance claims has revolutionized the way insurance agencies detect fraudulent activities and patterns. These activities include repeated filing of claims, submitting false information, and identity theft. To prevent fraud, agencies can closely monitor high-risk profiles and their future claims. After conducting proper authorization, AI tools streamline the insurance claim settlement process. Additionally, AI can efficiently detect any warning signs of fraudulent activity and alert both the insurer and the customer in real-time. This ensures faster and more accurate decision-making while improving customer satisfaction and loyalty.

Personalized Customer-Centric Experience

With insurance claims automation, industries can obtain their customers’ details efficiently. Artificial Intelligence (AI) is capable of unifying datasets and extracting insights from various documents. Thus, allowing employees to access and utilize information easily. Integrating enterprise automation solutions can improve and strengthen customer relationships. It enables insurers to monitor high-risk profiles, detect fraud, and streamline the claims settlement process. This leads to faster and more accurate decisions and ensures better customer satisfaction and loyalty.

Conclusion

Enterprises rely on an ecosystem of customers, products, and solutions for various business needs. The insurance industry is no exception. AI technologies, especially in cognitive automation, continue to advance. This leads to expanded capabilities in the insurance claim industry. Customized AI-powered solutions offer various solutions. Some of them include automated customer support, claims management, fraud prevention, query resolution, and personalized product recommendations. AI streamlines these complex processes, improves efficiency, and optimizes operational costs in the insurance sector. The integration of AI-led automation in insurance claims processes has further enhanced the industry’s ability to deliver efficient and effective services.

Automate Your Insurance Claim Process with E42

E42 is a no-code Cognitive Process Automation (CPA) platform. It creates multifunctional AI co-workers to automate enterprise functions across different verticals and domains. Our AI co-workers can automate several tasks. Some of these tasks include risk identification, real-time customer data extraction, automated chargeback reconciliation, streamlined insurance claim procedures, and more. To embark on your enterprise automation journey, write to us at interact@e42.ai!