In today’s hyper-competitive business landscape, where razor-thin margins are the norm, efficiency is paramount. Every department is tasked with streamlining processes, maximizing resources, and gaining a competitive edge. For finance teams, achieving this efficiency often revolves around automating Accounts Payable (AP). But with so many options available, how do you identify the best Accounts Payable automation solution for your business?

This article dives deep into E42’s innovative Accounts Payable process automation with Cognitive Process Automation (CPA), unveiling its advantages over traditional methods and its competitors. We’ll explore why manual processes in AP are a thing of the past, and how CPA drives real-time analysis, accurate data extraction, healthier financial systems, and secures those ever-important vendor discounts.

The Manual AP Maze: A Roadblock to Efficiency

Many businesses are still entrenched in a world filled with paper invoices, manual data entry, and the constant pursuit of approvals. These outdated methods are fraught with inefficiencies, leading to errors and inconsistencies due to the fallibility of manual data entry. These mistakes can cause delays, discrepancies, and even potential financial losses.

The paper trail created by manual processes acts as a bottleneck, hindering the speed of invoice processing and payment cycles. The lack of real-time data makes it difficult to track spending, forecast cash flow, and identify potential savings. Furthermore, late payments due to slow processing can strain vendor relationships.

In today’s competitive landscape, manual AP processes are more than just an inconvenience; they’re a drag on your business. They consume valuable resources, hinder strategic decision-making, and expose your business to financial risks. Manual processing leads to increased costs due to higher labor costs, rework expenses due to errors, and potential penalties for late payments. It also reduces productivity as your finance team gets bogged down in tedious tasks, preventing them from focusing on strategic initiatives. Additionally, paper invoices are susceptible to loss or damage, posing security risks for sensitive financial data.

Limitations of Traditional Accounts Payable Automation Solutions

Traditional Accounts Payable (AP) automation solutions, such as those based on Robotic Process Automation (RPA) or Optical Character Recognition (OCR), have been pivotal in streamlining certain tasks. However, these technologies often operate in silos and lack the capability to provide a seamless end-to-end automation experience. While they can handle specific, isolated tasks effectively, their inability to integrate and automate the entire AP process from procurement to payment is a significant limitation. This often results in the need for manual intervention at various stages, which can lead to inefficiencies and errors.

Robotic Process Automation: A Step Forward, But Not the Final Answer

RPA-based tools that are currently available certainly mark progress. Yet, they lack the nuanced understanding and flexibility required to handle complex, non-routine tasks that involve variability and require human-like decision-making abilities. This inherent limitation points to the fact that RPA is a step in the right direction but not the comprehensive answer for the evolving needs of business process automation.

Robotic Process Automation (RPA) emerged in the early 2000s as a solution to automate repetitive tasks in Accounts Payable (AP) processes. The technology behind RPA can be traced back to the 1990s with the development of screen scraping tools. While it offers benefits like increased efficiency and reduced errors, it has limitations.

- Limited Scope: RPA excels at mimicking human actions but struggles with complex tasks requiring judgment or adaptation

- Brittle Automation: RPA bots are easily disrupted by changes in invoice formats or layouts, requiring constant maintenance

- Limited Learning Capabilities: RPA cannot learn from experience or improve its accuracy over time

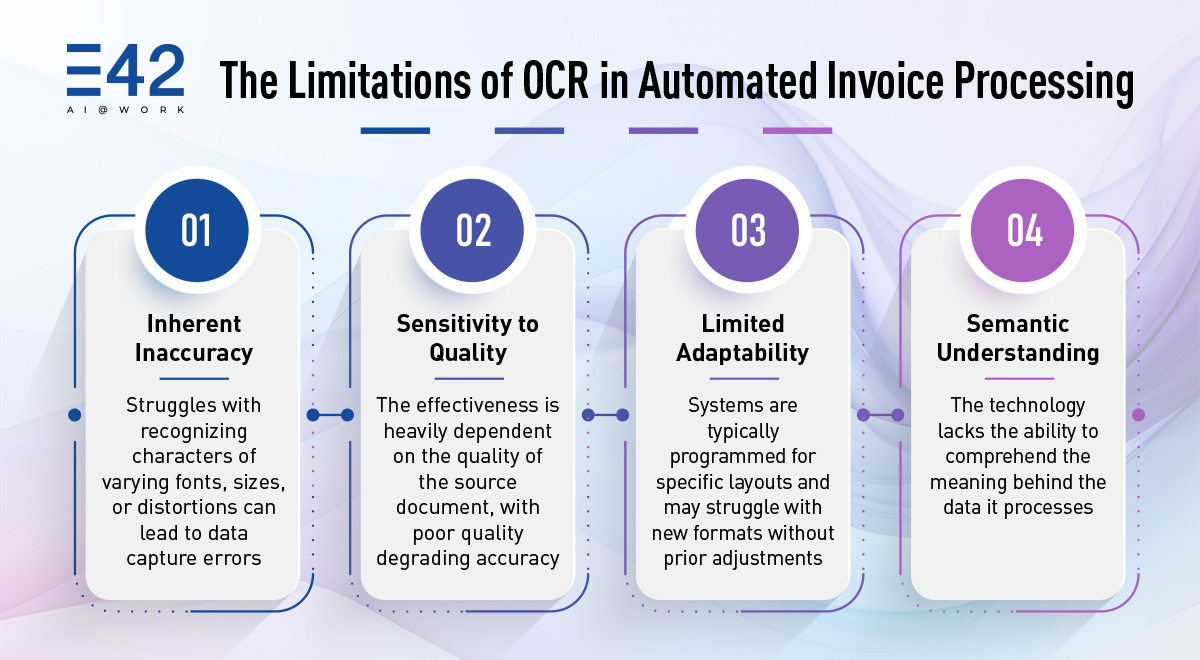

The Limitations of OCR in Automated Invoice Processing

Optical Character Recognition (OCR) technology has been instrumental in digitizing text from paper-based invoices, enabling automated data entry in Accounts Payable (AP) processes. Despite its advancements, OCR has its own set of limitations when it comes to handling the complexities of invoice processing:

- Inherent Inaccuracy: OCR technology is not infallible and can struggle with recognizing characters on invoices that have varying fonts, sizes, or are slightly distorted. This can lead to errors in data capture, which require human intervention to correct.

- Sensitivity to Quality: The effectiveness of OCR is heavily dependent on the quality of the source document. Poor quality scans or images with noise can significantly degrade OCR accuracy, necessitating additional manual review.

- Limited Adaptability: OCR systems are typically programmed for specific invoice layouts. When faced with a new format, they may not correctly identify and extract the relevant data without prior configuration or template adjustments.

- No Semantic Understanding: OCR cannot comprehend the meaning behind the data it processes. It cannot ascertain whether the extracted information makes sense within the broader context of the invoice or the business transaction it represents.

These limitations highlight that while OCR is a valuable tool in the automation toolkit, it is not a standalone solution for the nuanced and dynamic requirements of modern invoice processing. This is where the best Accounts Payable automation solution comes into play.

Why is E42’s Neil the Best Accounts Payable Automation Solution?

The Evolution of Accounts Payable Process Automation: Introducing Intelligent AI-Led End-to-End Automation of the Process with Generative AI and On-Premises LLMs

E42’s Accounts Payable automation solution—Neil, an AI Accounts Payable Executive takes a revolutionary step forward with Cognitive Process Automation technology at the core, further enhanced by the power of generative AI and on-premises Large Language Models (LLMs). Imagine a system that goes beyond simple automation, mimicking human intelligence to tackle complex tasks and continuously improving its capabilities. Here’s how Neil stands out as the best Accounts Payable automation solution:

- Understanding, not just mimicking: CPA powered Accounts Payable process automation can interpret invoice content, like line items and context, using machine learning capabilities and generative AI. It allows different parsing methods for various invoice formats, ensuring exceptional adaptability. Additionally, on-premises LLMs provide unparalleled processing power to handle even the most complex invoice structures. Unlike cloud-based solutions, on-premises LLMs offer greater security and control over your sensitive financial data.

- Self-learning and adaptation: Automating Accounts Payable requires continuous learning from experience, improving data extraction accuracy and adapting to new invoice formats and scenarios. On-premises LLMs further accelerate this process of automated Accounts Payable by analyzing vast amounts of invoice data stored securely on your own infrastructure to continuously refine data extraction techniques.

- End-to-End Automation with a Human in the Loop: Neil automates the entire AP process, from invoice capture and data extraction to approval workflows and payment processing, seamlessly ensuring human review for complex exceptions or approvals, ensuring both efficiency and accuracy.

E42’s Advanced ICR: Surpassing OCR Limitations in AP Automation

While OCR technology often struggles with less-than-ideal scans and non-standard formats, E42’s Intelligent Character Recognition (ICR) technology transcends these challenges. E42’s ICR not only captures data from diverse document types with higher accuracy but also learns from its interactions, continuously improving its ability to recognize and process information from invoices, even when dealing with cursive handwriting or new layouts. This is how Neil, the AI AP Executive built on E42 elevates the AP process with advanced ICR capabilities, offering a refined solution. Beyond OCR, ICR analyzes the context of the invoice including layouts, terminology, and invoice structures, allowing Neil to handle variations like customized templates or foreign languages with utmost accuracy.

Real-Time Analysis and a Healthier Financial System with E42

E42 brings a new level of efficiency and accuracy to your financial operations with Neil who is designed to streamline your back-office tasks, provide real-time insights into your financial obligations, and improve vendor relationships. Here’s how:

- Real-time Insights: Automating Accounts Payable helps gain immediate visibility into your financial obligations, allowing for better cash flow management and informed decision-making. You can identify early payment discounts and optimize your payment schedules to maximize financial benefits.

- Enhanced Accuracy: Minimized errors with intelligent data extraction, reducing rework and improving financial recordkeeping. Accurate data is crucial for generating reliable reports and making sound financial decisions.

- Streamlined Workflows: Automated manual tasks like data entry, invoice routing, and approval workflows free up your finance team to focus on more strategic initiatives, like analyzing spending patterns and identifying cost-saving opportunities.

- Improved Vendor Relationships: Faster invoice processing ensures timely payments, strengthening relationships with your vendors. Additionally, E42 can automate early payment discounts, further incentivizing on-time payments and improving vendor satisfaction.

E42’s Accounts Payable automation solution, Neil empowers you to capitalize on vendor discounts with early payments. With real-time invoice processing and automated payment scheduling, you can identify and take advantage of early payment opportunities you might have missed with manual processes. This translates to significant cost savings and a strong return on investment (ROI).

What Key Performance Indicators (KPIs) to Consider when Choosing the Best Accounts Payable Automation Solution?

When evaluating Accounts Payable automation solutions, go beyond basic features and focus on measurable benefits. Here are some key performance indicators (KPIs) to consider:

- Invoice processing time: Measure the time it takes to process an invoice from receipt to payment. E42’s CPA significantly reduces processing times compared to manual or RPA-based solutions.

- Data extraction accuracy: Track the accuracy of data extracted from invoices. E42’s ICR technology ensures superior accuracy, minimizing errors and rework.

- Straight-through processing (STP) rate: Measure the percentage of invoices processed automatically without human intervention. E42’s CPA strives for a high STP rate, maximizing efficiency.

- Return on investment (ROI): Evaluate the cost savings and efficiency gains achieved compared to the investment in the Accounts Payable automation solution. E42’s automation delivers a strong ROI through reduced costs, improved accuracy, and faster processing times.

In conclusion, Neil, an AI Accounts Payable Executive built on E42 is not just a tool, but a transformative shift in how businesses manage their back-office operations. By harnessing the power of generative AI, on-premises LLMs, and advanced ICR, Neil is setting a new standard for AP automation. This is the future of back-office operations—a future where automation, accuracy, and adaptability are not just goals, but the norm. To experience the best Accounts Payable automation software out there, get in touch with us at interact@e42.ai.