Running Accounts Payable inside a GCC is less like managing a function and more like coordinating traffic at a busy junction where every vehicle follows a different rulebook. The same invoice behaves differently depending on where it comes from, which ERP it touches, and which regulator ultimately cares about it.

An enterprise AP team manages a known fleet, defined routes, and a single operating authority. A GCC AP team, by contrast, is coordinating aircraft owned by different airlines, flying under different aviation laws, landing at different airports, all while being judged on safety, speed, and zero tolerance for failure. The planes may look similar, but the rules governing them are not.

That distinction matters, because most AP architectures were designed for the factory floor, not for air traffic control. As India’s Global Capability Centers take on deeper ownership of finance operations, GCC finance transformation is becoming essential, and AP is the first place where this mismatch becomes impossible to ignore.

India now hosts over 1,600 GCCs, many of which have evolved beyond transactional processing into global finance execution, compliance ownership, and control roles. Yet the underlying AP structures have not evolved at the same pace. Responsibility has expanded faster than control, and Accounts Payable is where that imbalance surfaces first.

The Union Budget 2026 made this shift clearer without explicitly calling it out. Increased emphasis on domestic manufacturing, export competitiveness, tighter GST enforcement, and digitized compliance all translate into higher invoice volumes and lower tolerance for ambiguity. GCCs are expected to absorb this complexity without proportional headcount growth, which makes finance transformation in GCC unavoidable rather than optional.

Why GCC AP Breaks Differently Than Enterprise AP

Enterprise AP functions operate within relatively bounded realities. Even global organizations eventually converge on shared accounting interpretations, escalation paths, and risk thresholds.

GCC finance transformation does not benefit from that convergence.

A single GCC team may process invoices for manufacturing plants across 4–6 countries, pharma operations with batch-level compliance requirements, export units governed by customs and forex regulations, and vendors billing through SAP Ariba, Oracle portals, local ERPs, email attachments, and scanned PDFs. These invoices may look structurally similar, but their downstream behavior differs materially once tax logic, receiving practices, and approval hierarchies come into play.

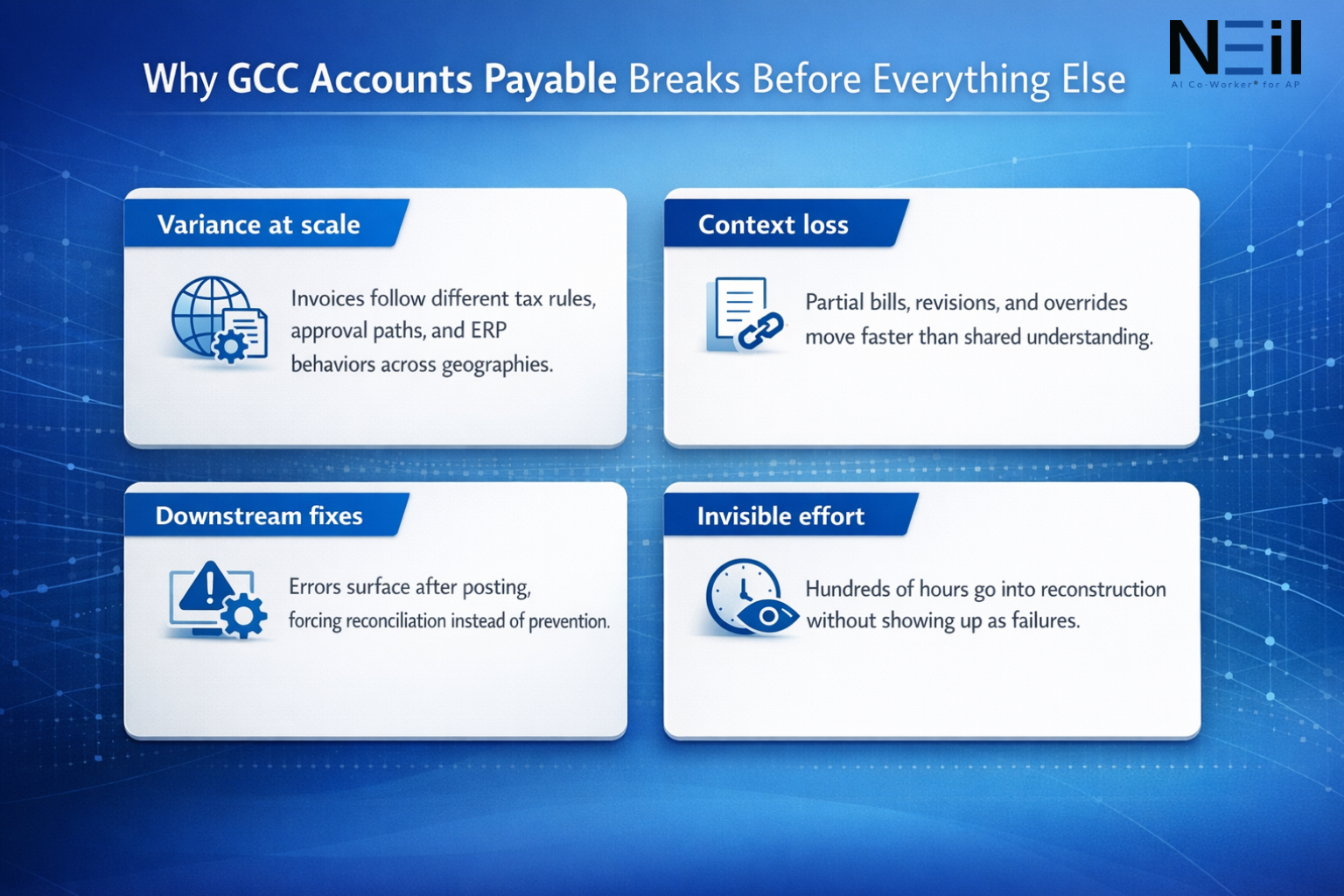

What clears cleanly in one geography can create audit exposure in another. Tolerances acceptable in manufacturing can violate statutory expectations in pharma. GCC AP teams are forced to reconcile these differences downstream, often without full upstream context. The issue is not volume alone, but variance at volume, a reality that drives the need for comprehensive global capability center transformation.

How AP Starts to Erode Inside GCCs

A partial invoice clears because tolerance thresholds allow it. Freight arrives later as a separate bill. A GRN posts locally but syncs late to the central ERP. A tax override is applied manually to meet a regional interpretation. A revised invoice is submitted under the same number with altered line values. Each step is defensible on its own, but together they create ambiguity that compounds quietly.

By the time finance leadership questions an aging balance or an unexplained accrual, the trail is already fragmented across ERPs, parked documents, email threads, and offline trackers. Reconstruction becomes the only option. In GCCs processing 20,000–30,000 invoices per month, this reconstruction effort consumes hundreds of hours without ever appearing as a formal failure metric.

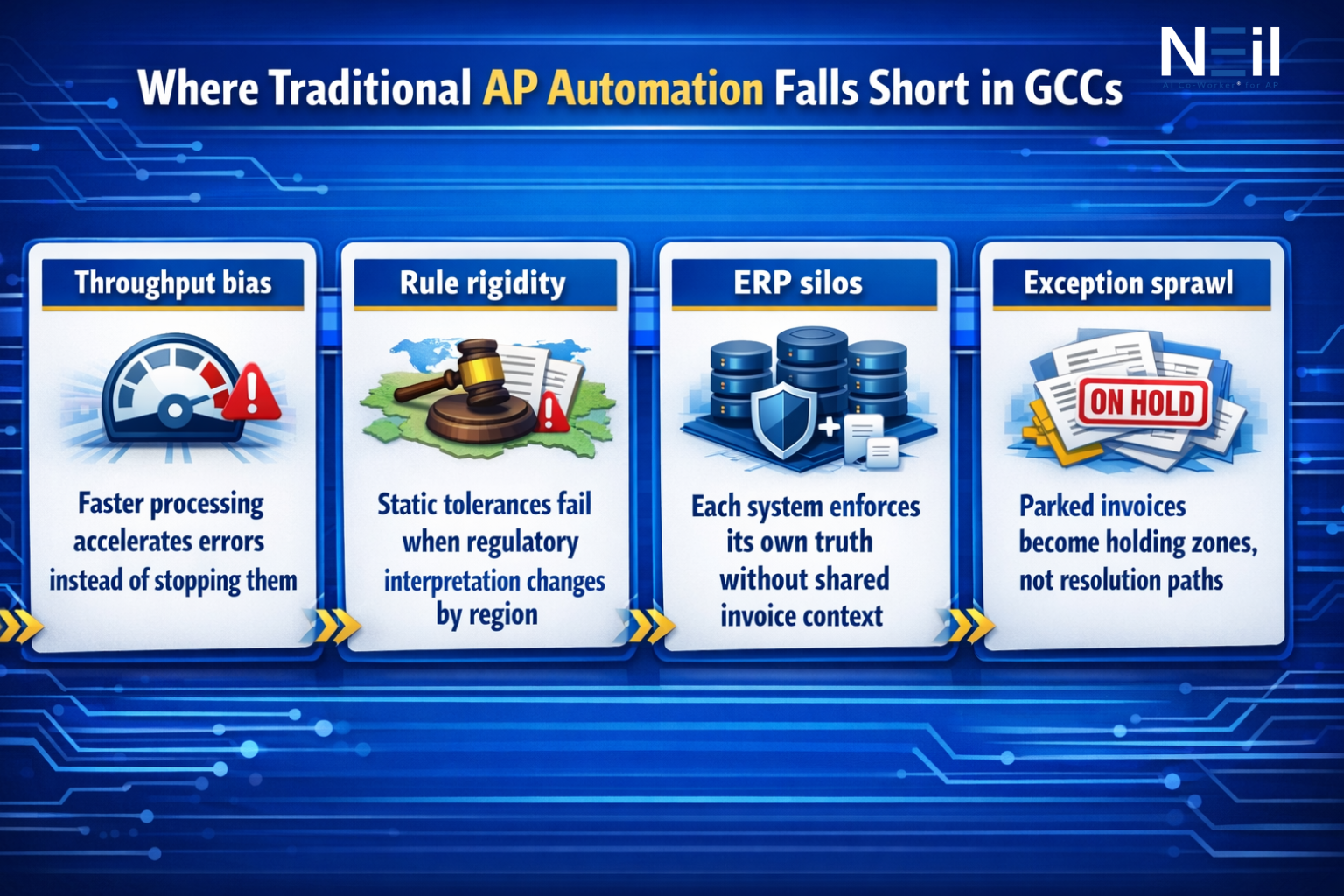

Traditional AP automation struggles here because it optimizes throughput rather than judgment timing. Moving invoices faster through the same structure accelerates drift instead of preventing it. This is precisely why GCC finance transformation requires a fundamentally different approach.

Why Manufacturing and Pharma GCCs Feel This First

Manufacturing AP is governed by physical reality. Goods often move before paperwork stabilizes. Partial receipts are normal; pricing adjustments are frequent, and logistics costs trail delivery. AP decisions are routinely made with incomplete information by design.

Pharma adds a second layer of pressure. Batch traceability, controlled pricing, retrospective corrections, and audit readiness mean invoices are rarely final at submission. Compliance expectations remain high even when operational data is still settling.

The Union Budget 2026 reinforced this tension. Incentives for domestic production and exports increase transaction volumes, while enforcement and reporting expectations tighten at the same time. The growing GCC accounts payable market reflects these pressures, with GCCs supporting these sectors experience the strain first because AP sits exactly where operational urgency meets financial accountability.

Why ERP-Centric Control Stops Working at GCC Scale

ERP systems enforce rules within defined boundaries. GCC AP operates across boundaries that shift constantly.

A tolerance rule valid in one country fails in another. Tax logic that works for domestic procurement breaks on exports. Approval workflows designed for one business unit introduce blind spots when reused globally. GCCs often respond by standardizing harder, adding more rules, templates, and exception categories, which increases complexity without improving control.

ERP-centric automation assumes consistency. GCC reality is variance. This is where finance transformation in GCC environments meaningfully diverges from automation.

What Accounts Payable Transformation Actually Means in GCCs

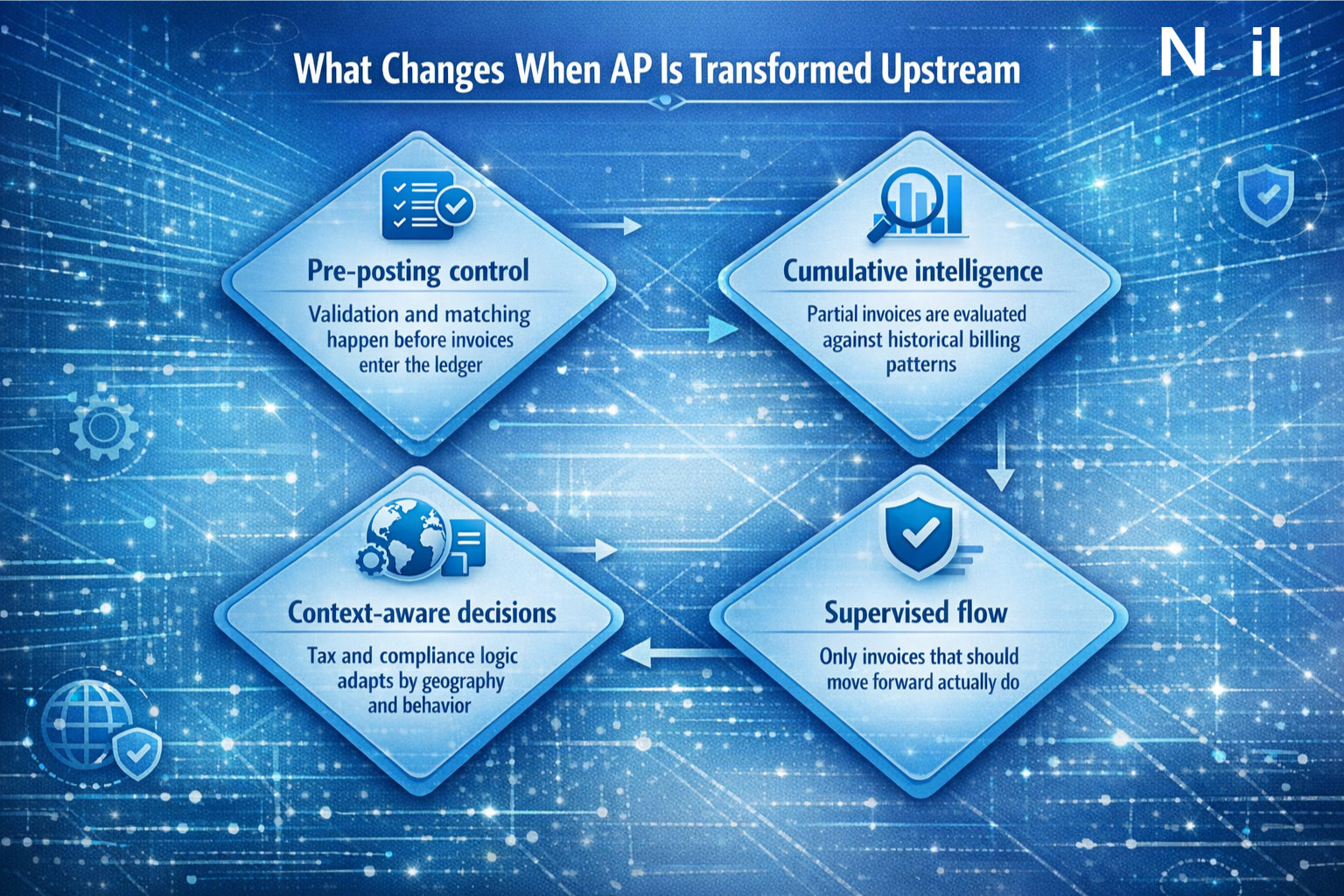

Accounts Payable AP transformation Inside GCCs is not about removing humans from the process. It is about relocating judgment earlier in the lifecycle, before invoices harden into financial truth.

Instead of allowing invoices to enter ERPs and fixing consequences later, transformed AP functions stabilize invoices before posting. This fundamentally changes the control model at scale and represents the core of successful GCC finance transformation initiatives.

What moves upstream in transformed GCC AP

- Pre-posting validation: 2-way, 3-way, and n-way checks occur before invoices touch the ledger, not during reconciliation

- Cumulative context: Partial invoices are evaluated against historical billing patterns rather than in isolation

- Context-aware tax logic: Regional interpretation is applied dynamically instead of through static rules

- Structured exception governance: Discrepancies are categorized and routed instead of being parked indefinitely

This upstream shift is where supervisory intelligence becomes necessary.

Neil’s Role in a GCC Architecture

Neil does not replace ERPs or shared services. He supervises the flow into them.

Neil coordinates a collection of specialized AI agents across invoice intake, extraction, validation, matching, tax interpretation, and posting readiness. Each agent focuses on a specific responsibility, but context is shared continuously. Data does not fragment as invoices move forward.

A partial invoice is assessed against prior installments. A tax override is evaluated against historical behavior and regional norms. An invoice that is structurally correct but contextually risky is surfaced before it contaminates downstream ledgers. For GCCs operating SAP alongside region-specific systems like Tally or other local ERPs, this supervisory layer becomes essential.

Control no longer depends on which ERP an invoice enters. It depends on whether the invoice should move forward at all.

The Metrics GCC Leaders Actually Care About

When Accounts Payable transformation works inside GCCs, impact shows up operationally rather than cosmetically.

Where leaders see the difference

- Month-end stability: Liabilities reflect reality instead of assumptions

- Vendor experience: Fewer escalations because invoice histories are coherent

- Audit readiness: Reviews replace reconstruction

- Team leverage: Finance effort shifts from cleanup to supervision

In Indian manufacturing GCCs, upstream invoice validation has reduced manual intervention by approximately 30–40% within 2–3 quarters. In pharma GCCs, audit observations tied to invoice lineage, tax treatment, and partial billing drop materially once controls move before posting, demonstrating the tangible ROI of finance transformation in GCC settings.

Why AP Becomes the Logical Starting Point

GCC re-architecture often begins with analytics or transformation programs. In practice, success depends on stabilizing the layer where complexity is highest and trust is weakest.

AP touches vendors, cash flow, compliance, and ERPs simultaneously. If AP is unstable, every downstream system inherits that instability. The Union Budget 2026 made this shift clearer without explicitly calling it out by increasing both volume and scrutiny at the same time.

Accounts Payable transformation works because it acknowledges a reality GCCs already live with: finance at scale is negotiated, contextual, and rarely clean. Designing that reality is no longer optional. It is the cost of growth.

FAQs

GCC finance transformation is the strategic restructuring of finance operations to handle multi-country compliance and scalable control. It’s critical because India’s GCCs have evolved from transactional processors to strategic finance hubs, requiring systems that manage variance at volume, not just throughput.

Enterprise AP operates with unified rules and systems. GCC AP manages invoices across 4–6 countries simultaneously, each with different tax regimes, ERPs, and compliance requirements. The same invoice behaves differently depending on geography.

Key challenges include managing partial invoices across geographies, reconciling separate freight bills, handling late ERP sync, applying region-specific tax overrides, and maintaining audit trails across fragmented systems—all intensified by Union Budget 2026’s increased volumes and tighter compliance.

Upstream control moves validation and compliance checks before invoices post to the ledger, rather than fixing issues during reconciliation. It includes pre-posting validation, evaluating partial invoices against historical patterns, and routing exceptions before they become parked documents.

Success shows in month-end stability, improved vendor experience, enhanced audit readiness, and better team leverage. Indian manufacturing GCCs typically see 30–40% reduction in manual intervention within 2–3 quarters.

ERPs enforce rules within defined boundaries, but GCC AP operates across constantly shifting boundaries. Tolerance rules, tax logic, and workflows valid in one country fail in another. ERP automation assumes consistency; GCC reality is variance.

Union Budget 2026 emphasizes domestic manufacturing, export competitiveness, tighter GST enforcement, and digitized compliance. This means higher invoice volumes with lower tolerance for ambiguity, making structural transformation unavoidable.