Decoding the Bedrock of Accounts Payable Automation

Accounts Payable automation optimizes financial operations by using technology to streamline and expedite the often tedious and time-consuming tasks inherent to the Accounts Payable cycle. This includes the automation of tasks like invoice processing, payment approvals, and vendor relationship management. Automation in the Accounts Payable process can help businesses to improve efficiency, reduce costs, and minimize errors. However, the success of any automation initiative hinges on the quality of the data being used.

Data validation is the process of verifying the accuracy, completeness, and consistency of data. In the context of Accounts Payable automation, these validation techniques play a crucial role:

- Field-level validation: In the realm of Accounts Payable, field-level validation guarantees that essential data elements, such as vendor information and invoice details, are in the correct format. For example, validating the accuracy of email addresses is vital for seamless communication with vendors.

- Record-level validation: Accounts Payable relies on the harmony of various data fields within each record, such as invoices. Validating the relationship between these fields ensures that the total invoice amount aligns with the sum of individual line items, minimizing discrepancies.

- Business rule validation: Business rules govern the approval and payment processes in Accounts Payable. Validating data against these rules is critical. For instance, ensuring that an invoice is only processed if it has received the necessary approvals.

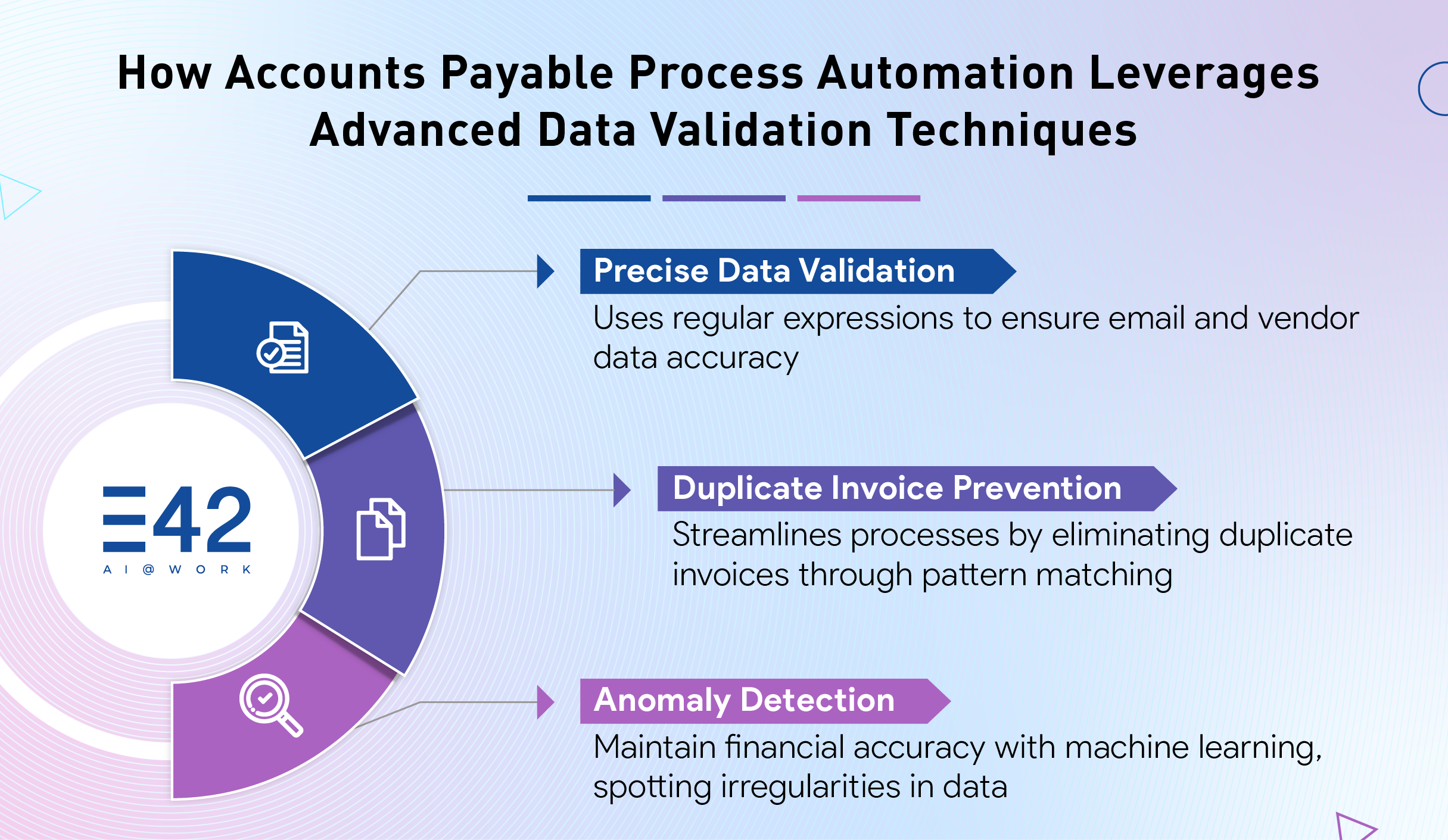

How Accounts Payable Process Automation Leverages Advanced Data Validation Techniques

In Accounts Payable automation, data validation extends beyond manual checks. Sophisticated algorithms and models bring a new level of automation and accuracy:

- Regular Expressions for Precise Data: In invoice processing, email addresses, vendor details, and other data must be precise. Regular expressions can be applied to validate the correctness of email addresses, ensuring accurate vendor communication.

- Pattern Matching to Eliminate Duplicates: Duplicate invoices can lead to confusion and errors. Pattern matching algorithms identify duplicates, streamlining the process and reducing the risk of overpayments.

- Machine Learning for Anomaly Detection: Automation systems need to identify irregularities within data. Machine learning models excel at spotting anomalies, such as invoices with unusually high or low amounts. This helps maintain financial accuracy and integrity.

Untapped Technical Efficiency Gains in Accounts Payable Automation

When data is accurate, complete, and consistent, automation systems can process invoices with improved data quality and make payments more quickly and accurately. This can lead to reduced processing times, fewer errors, and lower costs.

Efficient automation solutions leveraging cognitive AI and Intelligent Document Processing have the capability to detect and rectify data discrepancies, ensuring accurate data processing. Having said that, in Accounts Payable process automation, the significance of top-tier data quality cannot be overstated, as it substantially diminishes technical errors and the necessity for manual intervention.

High-quality data can also lead to improved throughput and efficiency in Accounts Payable process automation. When data is accurate, complete, and consistent, Accounts Payable automation solutions can process invoices and make payments more quickly. This can lead to reduced processing times and increased throughput.

For example, a study by Deloitte found that businesses that implemented Accounts Payable automation with high-quality data were able to reduce their invoice processing time by up to 80%.

Ensuring Data Security and Compliance in Automation

Data security and compliance are critical considerations in any automation environment. Businesses need to ensure that their data is protected from unauthorized access, use, disclosure, disruption, modification, or destruction.

Technical Intricacies of Data Security and Compliance: There are a number of technical intricacies involved in ensuring data security and compliance in Accounts Payable process automation. Some of the most important considerations include:

- Encryption: Encryption is a process of scrambling data so that it can only be read by authorized users. Accounts Payable automation solutions should encrypt all sensitive data, such as credit card numbers and bank account numbers.

- Access control: Access control mechanisms should be used to restrict access to data only to authorized users. For example, automation systems can use role-based access control (RBAC) to grant various levels of access to different users based on their job roles.

- Data isolation: Data isolation strategies should be used to prevent unauthorized access to data. For example, automation systems can use separate databases for diverse types of data, such as customer data and vendor data.

Implementing Technical Strategies for Ensuring High-Quality Data

There are technical strategies businesses can use to ensure high-quality data in Accounts Payable process automation. Some of the most important strategies include:

- Data validation: Data validation should be performed at all stages of the Accounts Payable process. This may involve using data validation tools and algorithms to check data for accuracy, completeness, and consistency.

- Data cleansing: Data cleansing is the process of identifying and correcting inaccurate, incomplete, or inconsistent data. Businesses should use data cleansing tools and techniques to ensure that their data is accurate and up to date.

- Data Governance: Data governance is the process of establishing and enforcing policies and procedures for managing data. Data governance is essential for ensuring the quality, security, and compliance of data in Accounts Payable automation.

Conclusion: The Data-Centric Future of Accounts Payable Process Automation

Accounts Payable process automation is rapidly evolving, and data is playing an increasingly significant role. The integration of advanced data validation techniques is the bedrock upon which the success of Accounts Payable automation rests. These techniques elevate the efficiency and accuracy of the automation process. With the implementation of sophisticated algorithms and machine learning, businesses can achieve unprecedented technical efficiency gains, reduced errors, and faster throughput. Furthermore, the interplay between data quality and data security underscores the pivotal role of high-quality data in safeguarding sensitive information.

As businesses expand, their evolving data requirements necessitate adaptable automation systems. In this ever-evolving environment, innovative technologies such as Intelligent Document Processing are catalyzing transformation, particularly in the realm of invoice data quality management. This entails the remarkable capability of AI techniques like Natural Language Processing and Intelligent Character Recognition to decipher and extract valuable insights from data of varying quality, thereby enhancing the overall data quality. By adopting automation solutions such as intelligent AI co-workers, businesses can confidently stride into the future of Accounts Payable automation, maintaining efficiency and relevance in an ever-evolving landscape.

Streamline Your Finance Operations with E42

E42 is a no-code Cognitive Process Automation (CPA) platform to build AI co-workers capable of automating various business processes with high speed and accuracy. Tailored for the finance domain, our AI co-workers excel in handling crucial tasks like Accounts Payable, Accounts Receivable, and financial reporting. Operating at an accelerated rate, these AI co-workers offer end-to-end process automation, benefiting both the finance team and the overall business. To embrace the future of finance with enterprise automation, get in touch with us at interact@e42.ai.