In the world of finance automation, a significant shift is underway, driven by the integration of advanced technologies. This blog post delves into the complex interplay between generative AI and Large Language Models (LLMs), and their combined effect on improving Accounts Payable (AP) processes.

Take, for instance, a bustling multinational corporation that receives hundreds of invoices daily. The AP department, traditionally burdened with manual data entry, grapples with challenges such as human error and inefficiency. Now, envision the role of LLMs and generative AI in the Accounts Payable process. These technologies, working together, can read, understand, and process these invoices, eliminating errors and significantly reducing processing time. Similarly, consider a small business owner who is juggling multiple roles, with little time to devote to financial management. The use of LLMs and generative AI can automate their AP processes, freeing up valuable time, and allowing them to focus on growing their business.

By leveraging LLMs and generative AI in Accounts Payable, we’re on the threshold of a new era marked by increased efficiency and accuracy in financial operations.

Real-World Applications: How LLMs and Generative AI Streamline AP Processes

Let’s understand the fundamental capabilities of LLMs and generative AI and dive deep into how they work together to automate and enhance AP workflows.

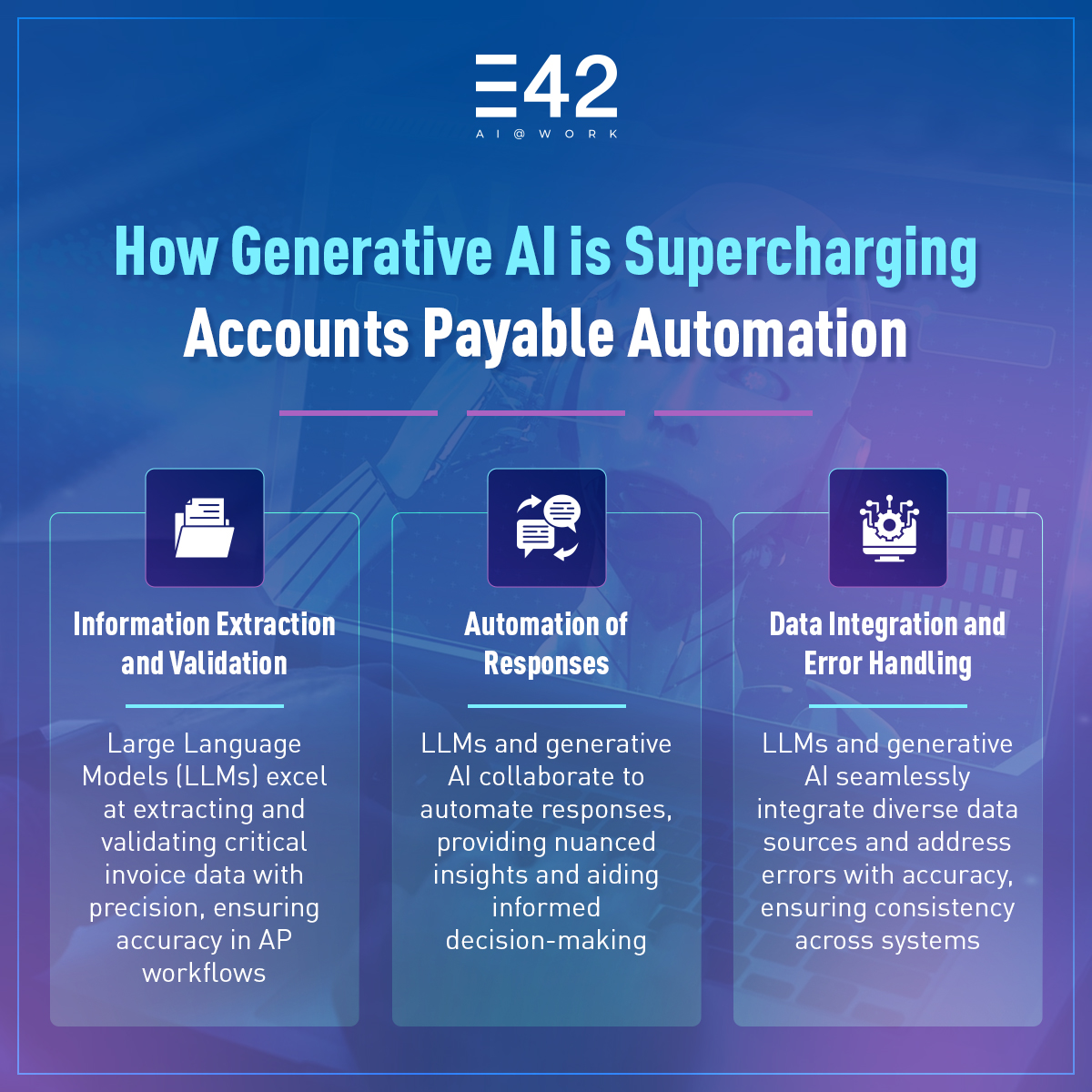

- Information Extraction and Data Validation: LLMs, equipped with their pre-trained contextual understanding, can tackle the complexities of unstructured invoice data, often riddled with inconsistencies and variations in format. By employing Natural Language Processing (NLP), LLMs perform highly accurate information extraction, pinpointing critical details like vendor names, invoice amounts, and due dates. Simultaneously, these models can validate extracted data by cross-referencing it against learned patterns and established business rules, ensuring the accuracy and reliability of information feeding into AP processes.

- Automation of Responses and Contextual Enrichment: The collaboration between LLMs and generative AI extends to automating responses based on the extracted data. LLMs, with their innate grasp of context, can contribute significantly to generating nuanced responses to queries or exceptions flagged during the AP process. This seamless integration of automated responses empowers informed decision-making by providing enriched insights into the context surrounding the extracted data.

- Data Integration and ICR Error Handling: LLMs excel in data integration tasks, adeptly synthesizing information from a multitude of sources and ensuring uniformity across various formats and systems. This proficiency is vital for organizations that handle invoices received through diverse channels like email, fax, and physical mail. Concurrently, during the rare occurrence of an ICR error, on-premises LLMs can significantly aid in mitigating it. By employing contextual checks and balances, they ensure the accuracy and reliability of the data.

Generative AI in Accounts Payable Automation: Injecting Intelligence into the Process

The automation revolution in Accounts Payable (AP) has transformed workflows, but there’s still room for growth. Enter generative AI, a powerful technology poised to propel AP beyond mere automation—bringing its unique skillset to the table, further amplifying the potential of AP automation. Here’s how:

- Synthetic Invoice Generation: Generative AI can create synthetic invoices that mimic real-world data. This capability proves invaluable for testing and training AP automation models, allowing for the creation of diverse scenarios without relying solely on historical data.

- Advanced Anomaly Detection: Leveraging its knowledge gleaned from vast datasets of invoices, generative AI in Accounts Payable can identify anomalies in real-time invoices with exceptional precision. The model can detect deviations from established patterns, such as unusual vendor names, significant fluctuations in invoice amounts, or inconsistencies in formatting, potentially flagging fraudulent activity or data entry errors.

- Predictive Analytics for Future-Proofing AP: The power of generative AI in Accounts Payable extends to predictive analytics. By extrapolating future trends from historical invoice data, the model can anticipate potential cash flow needs, identify upcoming invoice spikes, and even predict potential payment delays. This foresight empowers businesses to make proactive decisions regarding resource allocation and cash flow management.

Conclusion: A Symphony of Technologies

The convergence of LLMs and generative AI in Accounts Payable introduces a powerful and transformative force into AP automation. From the intricate tasks of information extraction to the technical finesse of predictive analytics, these technologies redefine the possibilities within financial processes. Embracing their collaborative power is not just a step forward; it’s a paradigm shift in the technical landscape of Accounts Payable automation. By leveraging generative AI in finance, businesses can unlock a new era of efficiency, accuracy, and cost-effectiveness within their financial operations.

Streamline Your Finance Operations with E42

E42 is a no-code platform to build AI co-workers that are not only capable of automating various business processes with high speed and accuracy, but also leverage Large Language Models (LLMs) and are equipped with generative AI capabilities. These AI co-workers, tailored for the finance domain, excel in handling crucial tasks like Accounts Payable, Accounts Receivable, and financial reporting. By operating at an accelerated rate, the AI co-workers offer end-to-end process automation, benefiting both the finance team and the overall business. To embrace the future of finance with enterprise automation, get in touch with us at interact@e42.ai.