In a bustling industrial city, a large manufacturing enterprise manages a multitude of financial transactions. They process a volume of invoices manually, with minimal to no automation in the system. Evidently, the accounting team faces tremendous challenges in finance operations. This is due to the complex and manual nature of their process, which urgently requires the implementation of finance process automation solutions. The tasks they handle include those pertaining to Accounts Payable and Accounts Receivable or liaising with the vendors for inaccuracies in the invoices.

Despite their best efforts, the team often makes mistakes and takes longer than they should to complete their tasks. This is because managing such a complex process with traditional methods is time-consuming and prone to human error.

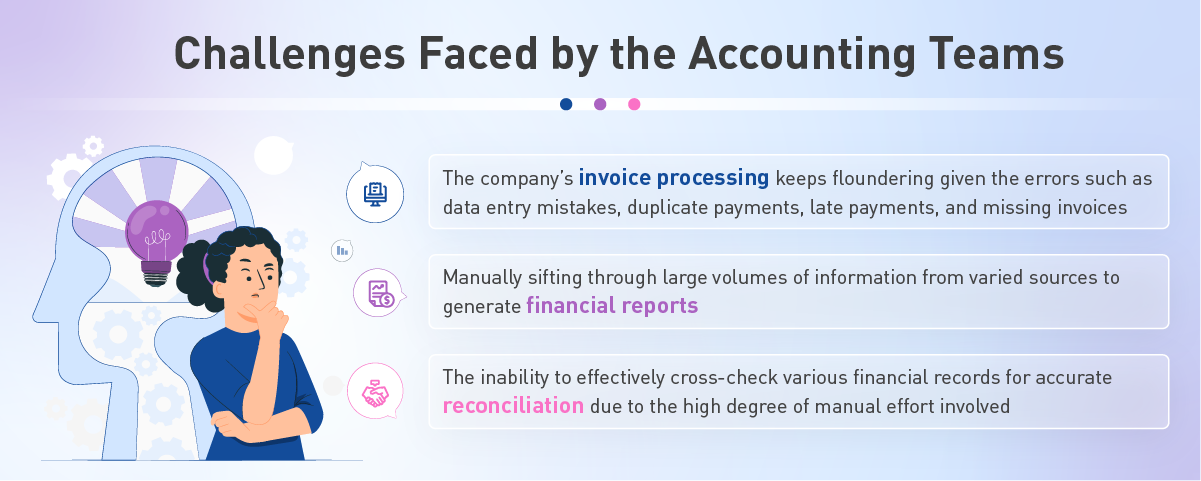

Unfortunately, this manual process is inevitable. It leads to inaccurate financial reporting and significant financial losses for the company. Everyone knows something has to change, but no one is sure how to bridge the gaps. To put things in perspective, here’s a list of the challenges faced by finance managers causing them to lose sleep:

Invoice Processing:

Invoice processing is crucial for ensuring accurate financial records and timely payments. It helps maintain good relationships with vendors and suppliers while avoiding compliance issues. However, the company’s invoice processing mechanism continues to struggle due to errors such as data entry mistakes, duplicate payments, late payments, and missing invoices. Implementing finance process automation solutions can streamline and improve this critical process significantly.

Reconciliation:

Reconciling accounts is crucial for ensuring the accuracy and completeness of financial records. However, the accounting team finds it challenging to cross-check various financial records accurately. This is due to the high degree of manual effort involved in accurately filing reconciliations. By adopting AI-led automation in the finance process, the reconciliation process can be optimized and made more efficient.

Financial Report Generation:

Generating financial reports is a significant task in accounting. It requires a high level of accuracy and attention to detail. The team finds it challenging to generate these reports efficiently. This is because it requires them to sift through large volumes of information from varied sources and collate all the data manually. With the entire process run manually, there’s a high risk of financial mismanagement. This can lead to potential financial losses and reputational damage for the company. That being said, with Accounts Payable automation solutions, the financial reporting process can be automated, leading to faster and more accurate results.

An AI-led Accounts Payable Automation Solution Comes to the Rescue!

The company’s finance heads were introduced to an AI-enabled Accounts Payable automation solution by chance. Within a week of implementation, AI-led automation solutions streamlined most of the finance processes that were done manually. It provided real-time reporting capabilities to catch errors, preventing potential financial disasters. This led to a faster, more accurate, and efficient finance process while reducing errors and improving reports for better decision-making. With this newfound efficiency, the finance team could focus on other crucial tasks. This, in turn, led to an increase in revenue and the ability to plan and strategize for scaling initiatives. Given the success of the deployment of AI-led automation in the finance process, the management decided to expand its use to HR management and customer service. This resulted in substantial growth, profitability, and an innovative reputation for the company in its industry

The Key Takeaways from the Story

An AI-led Automation Solution is the Answer for all Underlying Challenges in Finance Processes

It’s not uncommon to hear of a company grappling with manual accounting processes. This is a challenge that businesses of all sizes and across various industries encounter. Due to the repetitiveness and time-consuming nature of several accounting tasks, there’s always the potential for mistakes and delays. Fortunately, the rise of AI and automation has presented fresh opportunities for enhancing finance processes.

Here’s How!

AI-led automation in finance operations offers significant advantages over traditional methods. It automates critical functions like accounts receivable/payables management, cash flow analysis, audit compliance reporting, and more. This reduces the time required to complete these tasks, unlike traditional methods that take hours or days. With AI co-workers for accounts payable (AP) automation, businesses can perform multiple scenarios at lightning speed. This allows the team to make strategic decisions quickly and efficiently. The technology also helps companies to predict risks and identify opportunities, empowering them to make better decisions.

AI-Led Automation Benefits Extend Beyond Finance Processes

The story highlights that the advantages of AI-led automation extend beyond accounting. It can be applied to other business areas, such as customer service and supply chain management. By implementing AI-led automation in accounting, the company in the story achieved significant growth and profitability. This story exemplifies the transformative potential of AI in business. As AI continues to evolve, more and more businesses are expected to adopt it and enjoy its benefits.

Automate Your Finance Processes with E42

E42 is a no-code cognitive process automation (CPA) platform to build AI co-workers that automate various enterprise processes. The AI co-workers built on E42 utilize a blend of advanced AI and natural language processing (NLP) technologies to simulate human-like thinking and reasoning, but at a much faster pace. These co-workers can be deployed to revolutionize a wide range of processes, including finance.

To embark on your enterprise automation journey, write to us at interact@e42.ai!