In today’s fast-moving business environment, staying ahead of the competition requires a relentless pursuit of efficiency. Among the critical facets of efficiency, the management of a company’s finances stands out. Specifically, streamlining the Accounts Payable (AP) process can have a significant impact on a business’s bottom line. That is where Accounts Payable automation comes into play.

In this article, we will dive deep into how AI-driven automation of the AP process is not merely a cost-effective solution but a strategic asset that empowers businesses to optimize their financial processes, enhance competitiveness, and pave the way for sustainable growth eventually.

A glance at all that this article covers:

- Challenges in Manual Accounts Payable (AP) Processes

- Understanding Accounts Payable Automation

- Benefits of Accounts Payable Automation

- Getting Started with AP Automation

- Conclusion

- Streamline Your Finance Operations with E42

The Accounts Payable cycle is the financial backbone of any organization. It encompasses a comprehensive array of processes and responsibilities essential for the management and settlement of supplier or vendor invoices. These invoices are the lifeblood of a company’s operations, as they represent the payments owed for goods and services that keep the business running smoothly. Without an effective AP process, a company can face overdue payments, strained supplier relationships, financial inaccuracies, and operational disruptions. This is why optimizing AP processes is vital for the overall health and sustainability of a business.

Challenges in Manual Accounts Payable Processes

In today’s business landscape, many organizations continue to grapple with manual AP processes, which present a host of challenges. In this section, we will delve into the drawbacks of relying on manual AP processes, highlighting the need for automation to overcome these limitations.

- Vulnerability to Fraudulent Activities: Manual AP processes are more susceptible to fraudulent activities, including forged signatures and document authenticity issues. Without automation, it becomes challenging to detect and prevent these fraudulent attempts, potentially exposing the company to financial risks and reputation damage.

- Inefficient Data Handling: Manual processes often result in the loss of important data and physical documents like checks. This can lead to delays, financial risks, and hinder tracking and analysis of past transactions, impacting on the company’s financial stability.

- Decreased Efficiency and Increased Workload: Manual handling of invoices and payments can overwhelm AP teams, reducing their efficiency and productivity. This inefficiency not only slows down processes but also increases the risk of errors like data entry mistakes, delinquent payments, and missing invoices.

- Limited Real-Time Insights: Manual AP processes lack real-time data insights, making it challenging for AP teams to access up-to-date financial information. This limitation can affect decision-making and the ability to maintain strong relationships with vendors and suppliers while staying compliant.

In contrast, AI-led Accounts Payable automation solutions address these issues by enhancing accuracy, reducing the risk of fraud, improving efficiency, providing real-time data access, streamlining financial operations, and contributing to the company’s success.

Understanding the Accounts Payable Automation

Accounts Payable automation is a transformative approach that employs technology to streamline and automate the tasks involved in managing supplier invoices and payments. It is designed to enhance the efficiency of financial operations for businesses of all sizes.

The process involves efficient extraction of data from invoices and automating essential steps like n-way matching and General Ledger (GL) code mapping. This is achieved through the implementation of artificial intelligence (AI) and Cognitive Process Automation (CPA), which plays a significant role in reducing operational costs for enterprises.

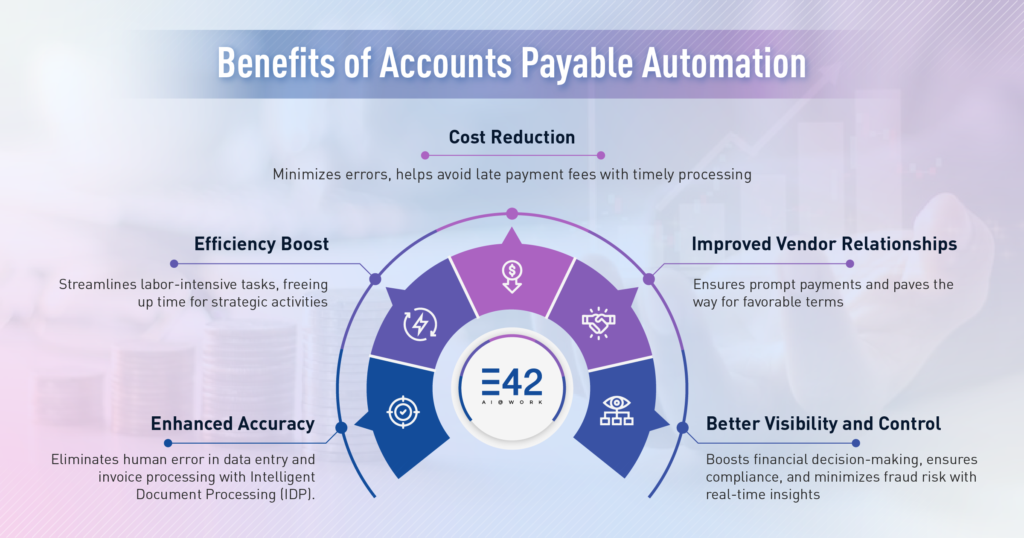

Benefits of Accounts Payable Automation

CPA-powered Accounts Payable (AP) automation brings many benefits to businesses, enhancing efficiency and accuracy while reducing costs. Here is a brief overview:

- Enhanced Accuracy: One of the primary advantages of AP automation is improved accuracy. Manual data entry and invoice processing are prone to human errors, which can be costly and time-consuming to rectify. With invoice processing automation, the risk of errors is significantly reduced, leading to more accurate financial records.

- Efficiency Boost: Manual AP processes can be labor-intensive, requiring employees to spend valuable time on tasks like data entry and invoice matching. AP automation streamlines these processes, freeing up time to focus on more strategic activities.

- Cost Reduction: By reducing the need for manual labor and minimizing errors, AP automation can lead to substantial cost savings. It can also help enterprises avoid late payment fees by ensuring that invoices are processed and paid on time.

- Improved Vendor Relationships: Prompt and accurate payments with AP automation allows businesses to pay invoices promptly, strengthening vendor relationships and potentially leading to favorable terms and discounts.

- Greater Visibility and Control: AP automation empowers organizations to make informed financial decisions while minimizing the risk of costly mistakes or fraud by providing real-time insights into financial obligations. This reduces errors and ensures compliance with company policies and regulations.

Getting Started with AP Automation

Here are the key steps to effectively implement AP automation:

- Evaluate current AP processes and set clear goals: Analyzing existing operations, identifying bottlenecks like manual data entry, and establishing objectives for faster and more accurate invoice processing automation.

- Choose the right AP automation tools: Selecting solutions designed for AP workflows, featuring intelligent document processing and seamless integration with existing systems.

- Use data analytics for AP performance: Implementing real-time reporting to pinpoint trends and enhance cash flow management.

- Prioritize data security: Ensuring robust encryption, access controls, and compliance with data protection regulations.

- Streamline AP and AR with smart document processing: Utilizing NLP for automated data capture and validation, expediting invoice processing.

- Follow a structured implementation process: Planning systematically, assessing needs, choosing the ideal solution, customizing, and providing comprehensive team training.

- Stick to best practices: Engaging stakeholders, maintaining data quality, executing thorough testing, and continuously monitoring and enhancing AP automation for sustained success.

Conclusion

The strategic adoption of Accounts Payable automation is a crucial step for businesses seeking to improve the efficiency, accuracy, and competitiveness of their financial operations. By implementing AP automation solutions, organizations can revolutionize their financial processes, automate manual tasks, gain insightful data, and streamline workflows. Essentially, enterprises should automate Accounts Payable processes to enable a data-centric approach that promotes informed decision-making and exponential business growth in the ever-evolving world of modern finance.

Streamline Your Finance Operations with E42

E42 is a no-code Cognitive Process Automation (CPA) platform to build AI co-workers that automate business processes across functions with high speed and accuracy. Tailored for the finance domain, the AI co-workers built on E42 excel in handling crucial tasks like Accounts Payable, Accounts Receivable, and financial reporting thus serving as the perfect Accounts Payable automation solution. Operating at an accelerated rate, these AI co-workers offer end-to-end process automation, benefiting both the finance team and the overall business. To automate your Accounts Payable process, get in touch with us at interact@e42.ai.