Traditional Accounts Payable (AP) processes often pose a significant challenge in our everyday business world. Before we delve into the use cases of generative AI, let’s take a moment to understand the current situation. These systems, which heavily rely on manual data entry, are not only labor-intensive but also fraught with potential pitfalls. A simple human error—a misplaced decimal, a mistyped figure—can cascade into substantial financial discrepancies, demanding hours of painstaking reconciliation efforts and risking financial losses. Ardent Partners’ latest report highlights this vulnerability, revealing an average invoice error rate of 3.6%, translating into consequential financial impacts over time (Ardent Partners, 2023).

Furthermore, the plodding pace of manual processing, averaging 10.4 days (about 1 and a half weeks) per invoice according to the Aberdeen Group (2022), exacerbates challenges by delaying payments and straining supplier relationships, potentially forfeiting early payment discounts. Moreover, the inherent lack of transparency and control in traditional AP processes further complicates effective cash flow management for businesses.

The Problem: Challenges of Traditional AP Automation

Traditional AP processes face several challenges beyond the core issues. One of the significant problems is limited scalability. As the volume of invoices increases, the workload of AP staff also rises. This increase makes it difficult to scale operations effectively and efficiently. Another challenge is the manual management of invoices, that makes it tough to ensure adherence to regulatory requirements and internal control procedures. This difficulty can lead to potential compliance issues.

Furthermore, manual processes are more susceptible to fraud. The lack of automated controls and oversight can increase vulnerability to fraudulent activities. This susceptibility can pose a significant risk to the organization.

Lastly, traditional AP processes often struggle with reporting and analytics. Manual data entry can make it challenging to generate real-time reports and gain insights into spending patterns. This limitation can hinder strategic decision-making and operational efficiency.

The Solution: The Many Benefits of Generative AI in Finance

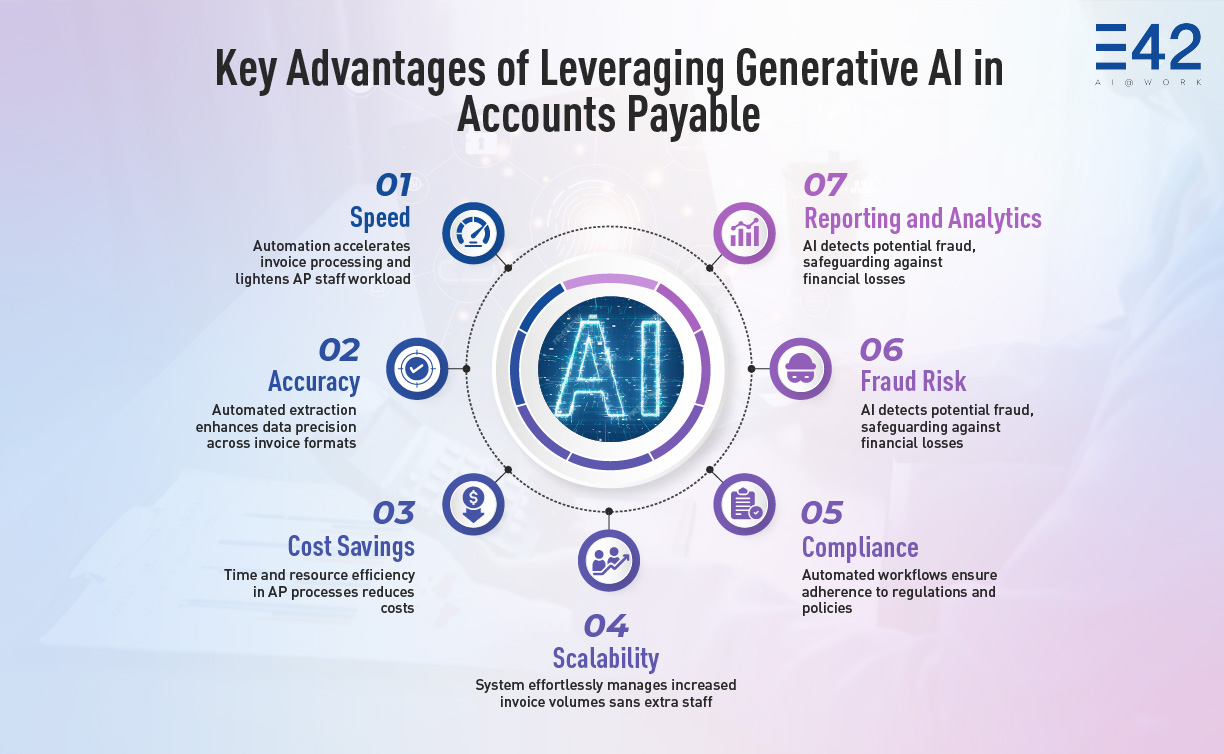

Generative AI, a subset of artificial intelligence, is a game-changer for AP automation. At its core, generative AI leverages Large Language Models (LLMs) to understand, learn, and generate human-like text. When applied to AP automation, it can understand invoice data, learn patterns, and generate actions such as data entry, approval workflows, and more. Some of the key advantages of generative AI in finance are:

- Speed: Significantly increases speed by automating data entry and other manual tasks, leading to faster invoice processing cycles, improved efficiency, and reduced workload for AP staff

- Accuracy: Improves accuracy as the data extraction is automated, reducing the chances of errors. It can handle various invoice formats, ensuring accurate data capture.

- Cost Savings: Leads to cost savings by reducing the time and resources required for AP processes. Reduced errors can prevent financial losses due to incorrect payments or missed discounts.

- Scalability: Generative AI systems can effortlessly handle increased invoice volumes without requiring additional personnel

- Compliance: Automated workflows and controls ensure adherence to regulatory requirements and internal policies

- Fraud Risk: AI-powered anomaly detection can identify potential fraudulent activities and prevent financial losses

- Reporting and Analytics: Generative AI can automatically generate detailed reports on spending patterns, supplier performance, and other key metrics

Diving Deeper: Use Cases of Generative AI in AP Automation

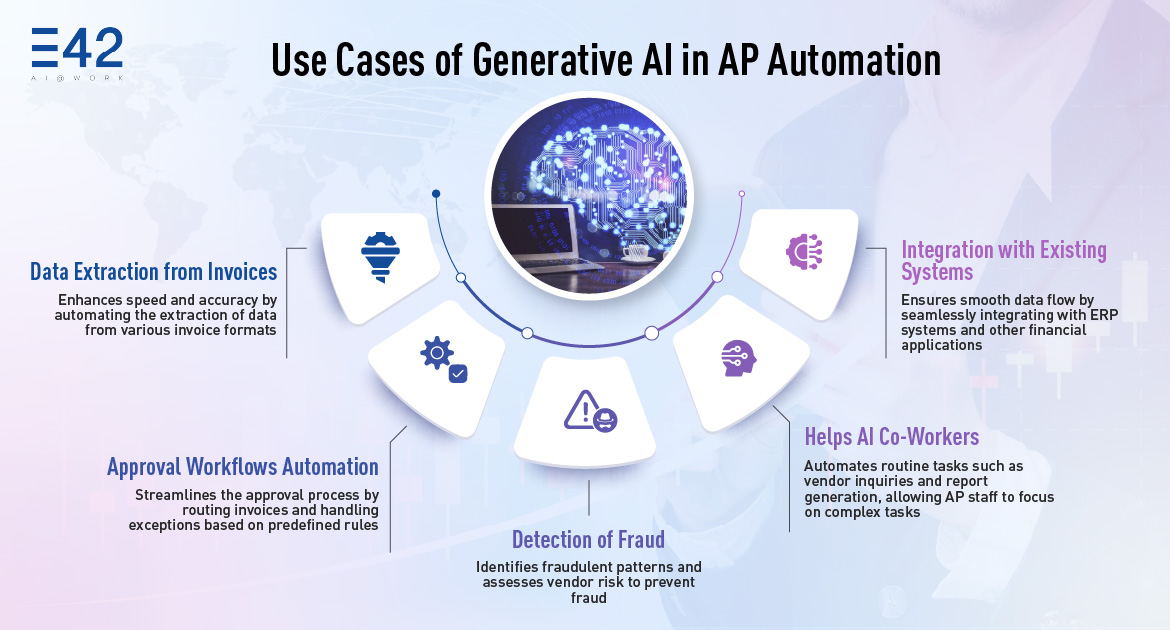

From automating invoice data extraction and streamlining approval workflows to enhancing forecasting and predictive analytics, generative AI offers transformative use cases that optimize efficiency and accuracy in financial operations. These applications not only reduce manual effort but also enable proactive management of supplier relationships and regulatory compliance, setting the stage for enhanced strategic decision-making and operational excellence in finance.

Let’s delve deeper into some specific use cases of generative AI in financial services:

Invoice Data Extraction

One of the most time-consuming tasks in the AP process is data extraction from invoices. Invoices come in various formats, from structured PDFs to unstructured formats like scanned images and emails. Extracting data manually from each one can be a tedious task.

One of the key technical aspects of how generative AI can enhance Intelligent Character Recognition (ICR) which is at the core of automated invoice processing is using Generative Adversarial Networks (GANs).

Here’s how GANs work in this context:

- Generator Network: This network acts like a forger, creating synthetic invoice data. This data mimics real-world invoices in terms of format, content, and even potential errors.

- Discriminator Network: This network plays the role of a detective. It analyzes both real invoices and the synthetic ones generated by the first network, trying to tell the difference.

Through this competitive process, both networks learn from each other. The generator becomes increasingly adept at creating highly realistic synthetic invoice data, while the discriminator hones its ability to discern real from fake.

Data Augmentation: The Power of Synthetic Invoices

The synthetic invoices created by the GAN have a valuable secondary function: data augmentation. This essentially means using the synthetic data to ‘bulk up’ the existing training data for ICR models. By incorporating this expanded dataset, the ICR model encounters a wider range of variations in invoice formats and content. This improved training allows the ICR model to handle the complexities of real-world invoices with greater accuracy and efficiency.

Approval Workflows

Another critical aspect of AP is the approval workflow. Invoices need to be approved by the appropriate personnel before payment can be made. This process can be time-consuming and prone to delays, especially if approvals require routing to different departments or individuals based on specific criteria. Generative AI can automate the approval workflow based on predefined rules. Here’s how:

- Automated Routing: LLMs can analyze invoice data and automatically route invoices to the appropriate approvers based on pre-defined criteria, such as purchase order number, department, or spending limit. This eliminates manual routing steps and streamlines the approval process.

- Exception Handling: Generative AI can identify invoices that require special attention, such as those exceeding a certain amount or containing unusual line items. These exceptions can be automatically flagged for manual review by relevant personnel, ensuring proper oversight while expediting routine approvals.

- Dynamic Learning: Over time, generative AI can learn approval patterns and suggest optimized workflows. For instance, the system might identify instances where certain approvals are consistently bypassed or delayed. Based on this data, it can recommend adjustments to the workflow for improved efficiency.

An AI Co-Worker for the AP Teams

Generative AI can power virtual assistants or AI co-workers for the AP teams, automating routine tasks and improving efficiency. Here are some examples:

- Responding to Vendor Inquiries: With the help of generative AI, these virtual assistants or AI co-workers can answer basic vendor inquiries about invoice status, payment schedules, and other common questions.

- Generating Reports: LLMs can automatically generate reports on various aspects of the AP process, such as invoice processing times, supplier performance metrics, and spending trends. This allows AP teams to gain valuable insights and make data-driven decisions.

- Predictive Analytics: The AI analyzes historical data to predict future invoice volumes and cash flow needs—allowing businesses to proactively manage their resources and optimize cash flow management.

The Future of Generative AI in Accounts Payable

The future of Generative AI in Accounts Payable is bright and brimming with potential. Here are some exciting possibilities on the horizon:

- Enhanced Learning Capabilities: As LLMs continue to evolve, their ability to learn and adapt will further enhance their effectiveness in AP automation. They can personalize workflows based on individual user behavior and preferences, further streamlining the process.

- Cognitive Automation: Generative AI’s role goes beyond data extraction in invoice processing. It fuels cognitive automation, where AI understands invoice context, analyzes data and flags mismatches in quantities or pricing along with making intelligent decisions. Based on context, the AI can suggest payment terms or initiate workflows to resolve discrepancies, significantly improving AP efficiency.

Conclusion: Streamlining AP with Generative AI

Generative AI not only automates manual tasks but also minimizes errors, thereby reducing costs. It streamlines workflows, liberating the AP teams to focus on strategic tasks and enhancing overall efficiency. The accuracy in invoice processing is significantly improved, ensuring precise data capture and reducing the risk of costly mistakes. With real-time insights into spending patterns and supplier performance, businesses gain increased visibility. Compliance is also improved as workflows and controls are automated to ensure adherence to regulations. Generative AI, once a futuristic concept, is now a practical solution revolutionizing AP automation. Those who embrace this technology will optimize their financial operations and achieve greater operational efficiency, gaining a significant competitive edge.

To explore the potential of generative AI in streamlining your AP processes and propelling your business into the future of automation, get in touch with us at interact@e42.ai.